Classifying Your Workers Correctly

In California, you must apply the ABC test under state law to decide if a worker is an employee or an independent contractor, alongside the federal IRS common‑law control test. Employees are typically subject to your direction, use your tools, and perform work within your usual course of business, while contractors operate independently and serve multiple clients.

Misclassification can trigger back wages, unpaid overtime, tax assessments, civil penalties, and liability for missed benefits and reimbursements. Your company should document classification decisions and review high‑risk roles regularly – this guide on misclassification is a useful reference.

Verify Employee Work Eligibility

For every employee working in California, you must complete federal Form I‑9 within 3 business days of the start date to verify identity and work authorization. You must physically or via an approved remote process inspect original documents from the Lists of Acceptable Documents, such as a U.S. passport or a combination of driver’s license and Social Security card.

California does not mandate E‑Verify for most private employers, but you may use it voluntarily if you follow both federal program rules and state privacy and anti‑discrimination protections. You must retain I‑9s for at least 3 years after the hire date or 1 year after termination, whichever is later, and store them separately from general personnel files for easier audits.

Create an Employee Onboarding Process

Your onboarding process in California should include a compliant offer letter, federal Form W‑4, state DE 4 withholding form, direct deposit authorization, and signed acknowledgments of your handbook and key policies. You must also provide required state notices, such as wage theft prevention notices for non‑exempt employees, sexual harassment information, paid sick leave details, and workers’ compensation coverage information.

Collect emergency contacts, I‑9 documentation, and any benefit enrollment forms within the first few days so payroll and benefits start correctly and on time. When you map each step and cost up front, you gain clear visibility into the true cost of hiring in California and can budget more accurately for growth.

Pay Frequency & Methods

In California, you must pay non‑exempt employees at least twice per month, with specific paydays designated in advance, and wages earned between the 1st and 15th generally payable by the 26th. Final wages are due immediately at the time of termination if you discharge an employee, and within 72 hours if the employee resigns without notice, with waiting time penalties accruing if you pay late.

Payment Methods (How You Can Pay)

You can choose from several payment methods in California, but you must always ensure employees receive full, timely wages and an accurate itemized wage statement each pay period.

- Payroll Check: You may pay by check drawn on a California bank, and you must allow employees to cash it at full face value without fees.

- Cash: You may pay wages in cash, but you must still provide a detailed wage statement and maintain accurate payroll records for at least 3 years.

- Direct Deposit (EFT): You may use direct deposit only with the employee’s voluntary written consent, and you must offer an alternative if they opt out.

- Paycards: You may use paycards if employees have fee‑free access to full wages each pay period and receive clear disclosures of any card terms.

- Outsourced Payroll: You may outsource payroll to a provider, but your company remains legally responsible for correct wage payments, taxes, and filings.

When choosing methods, you should balance employee preferences, banking access, and your recordkeeping needs, while ensuring every option complies with California’s strict wage statement and timing rules.

When you hire in California, you must withhold and remit federal and state payroll taxes and pay several employer‑only contributions. Registering promptly and filing on time helps your company avoid penalties, interest, and personal liability for certain unpaid taxes.

Employer Tax Contributions

As a California employer, you must register with the Employment Development Department (EDD) within 15 days of paying over USD 100 in wages in a calendar quarter. You’ll then owe state unemployment insurance, employment training tax, and state disability insurance withholding, in addition to your federal employer taxes.

Employee Payroll Tax Contributions

Your company must withhold federal income tax, employee FICA, California personal income tax, and state disability insurance from employee paychecks. You must deposit these amounts on the required schedule and provide year‑end Forms W‑2 so employees can file their returns.

Minimum Wage in California

As of 2026, California’s statewide minimum wage is USD 16.90 per hour for most employees, with some cities and counties imposing higher local minimums that your company must follow if they are more generous. You must also comply with special rules for certain industries, such as fast‑food and healthcare, where sector‑specific minimums may exceed the general rate.

Working Hours in California

California generally treats 8 hours per workday and 40 hours per workweek as the standard for non‑exempt employees, and you must provide meal and rest breaks once employees work set thresholds of hours. You should track hours worked each day, including start and stop times and meal periods, to comply with strict recordkeeping and break‑time requirements.

Overtime in California

Non‑exempt employees in California are typically entitled to 1.5 times their regular rate for hours worked over 8 in a day or 40 in a week, and for the first 8 hours on the seventh consecutive day of work in a workweek. Double‑time pay is generally required for hours over 12 in a day and for hours over 8 on the seventh consecutive day, so your scheduling and payroll systems must be configured to calculate these premiums accurately.

In California, offering a competitive benefits package – including health insurance, retirement plans, and paid time off – helps you attract and retain talent in a high‑cost market. If you average 50 or more full‑time employees across the U.S., the federal Affordable Care Act requires you to offer affordable, minimum‑value health coverage or face potential penalties.

Mandatory Leave Policies in California

Paid Time Off in California

California does not require general vacation or PTO, but once your company offers it, accrued vacation is treated as earned wages that cannot be forfeited. You must allow employees to carry over accrued vacation or use a reasonable cap, and you must pay out all unused, accrued vacation at the employee’s final rate of pay when employment ends.

Many employers combine vacation and sick time into a single PTO bank, but you must still ensure the PTO policy meets or exceeds the state’s minimum paid sick leave requirements and any more generous local ordinances. Clear written policies on accrual, caps, and scheduling help you manage costs and avoid wage claims.

Maternity & Paternity Leave in California

California provides strong protections for maternity and paternity leave through Pregnancy Disability Leave, the California Family Rights Act, and Paid Family Leave wage‑replacement benefits. A birth parent may be entitled to up to 4 months of PDL for pregnancy‑related disability, followed by up to 12 weeks of CFRA bonding leave, with PFL benefits partially replacing wages during bonding periods.

Non‑birth parents and adoptive or foster parents may also qualify for CFRA bonding leave and PFL benefits if eligibility criteria are met. Your company must maintain health benefits during CFRA leave and ensure employees are reinstated to the same or a comparable position at the end of protected leave.

Sick Leave in California

Under California’s paid sick leave law, most employees who work at least 30 days in a year for the same employer in the state accrue paid sick time, typically at a rate of at least 1 hour per 30 hours worked. You may front‑load sick leave annually or use an accrual system, but you must allow employees to use at least the statutory minimum hours per year for their own or a family member’s illness, preventive care, or certain safety‑related reasons.

Several cities and counties, such as Los Angeles and San Francisco, have local ordinances that provide more generous sick leave benefits, and your company must follow whichever rule is more favorable to the employee. You should communicate accrual rates, carryover rules, and usage procedures clearly in your handbook and on wage statements where required.

Military Leave in California

Employees who are members of the armed forces, reserves, or National Guard are protected by both federal USERRA and California military leave laws. You must grant unpaid leave for qualifying military service, protect the employee’s job and seniority rights, and reinstate them upon timely return from duty.

California also provides specific protections for employees who are spouses or registered domestic partners of service members, including certain short‑term leaves when the service member is on leave from deployment. While pay during military leave is not generally required, many employers choose to offer differential pay as a competitive benefit.

Jury Duty in California

California law requires you to allow employees time off to serve on a jury or comply with a subpoena, and you may not discipline or terminate them for doing so. You are not required to pay non‑exempt employees for this time, but you must allow them to use accrued vacation or PTO if your policy permits.

Some employers voluntarily pay for a set number of jury duty days to support employees and reduce financial stress. You may request proof of jury service, such as a summons or attendance slip, and you should outline your expectations in your leave policy.

Voting Leave in California

California requires you to provide up to 2 hours of paid time off at the beginning or end of a shift if an employee does not have sufficient time to vote outside working hours. Employees should give you at least 2 working days’ notice if they need time off to vote.

You must also post a notice about employees’ voting rights at least 10 days before each statewide election. Planning schedules around election days can help you minimize disruption while supporting civic participation.

Bereavement Leave in California

California law provides certain employees with the right to take up to 5 days of bereavement leave upon the death of a qualifying family member, though the leave may be unpaid unless your policy or a collective bargaining agreement states otherwise. You may require documentation, such as a death certificate or obituary, as long as your request is reasonable and consistent.

Many employers choose to offer a set amount of paid bereavement leave as part of their standard benefits package to support employees during difficult times. Clear eligibility rules and procedures in your handbook help ensure consistent and compassionate administration.

Termination Process

California is generally an at‑will employment state, but you must still follow your written policies, contracts, and any applicable collective bargaining agreements when ending employment. You should document performance issues, provide final wage payments on time, and give required notices such as unemployment insurance information and COBRA or Cal‑COBRA continuation details.

Notice Period

State law does not usually require advance notice for individual terminations, but larger layoffs or plant closures may trigger federal WARN or California WARN notice obligations, often requiring 60 days’ advance written notice. Even when not legally required, providing reasonable notice or severance can reduce risk and support smoother transitions.

Severance

California does not mandate severance pay, but many employers offer it in exchange for a signed release of claims, especially in layoffs or negotiated separations. If you provide severance, you should use a clear written agreement that complies with state and federal rules on releases, age discrimination waivers, and payment timing.

How do you set up payroll processing in California?

.png)

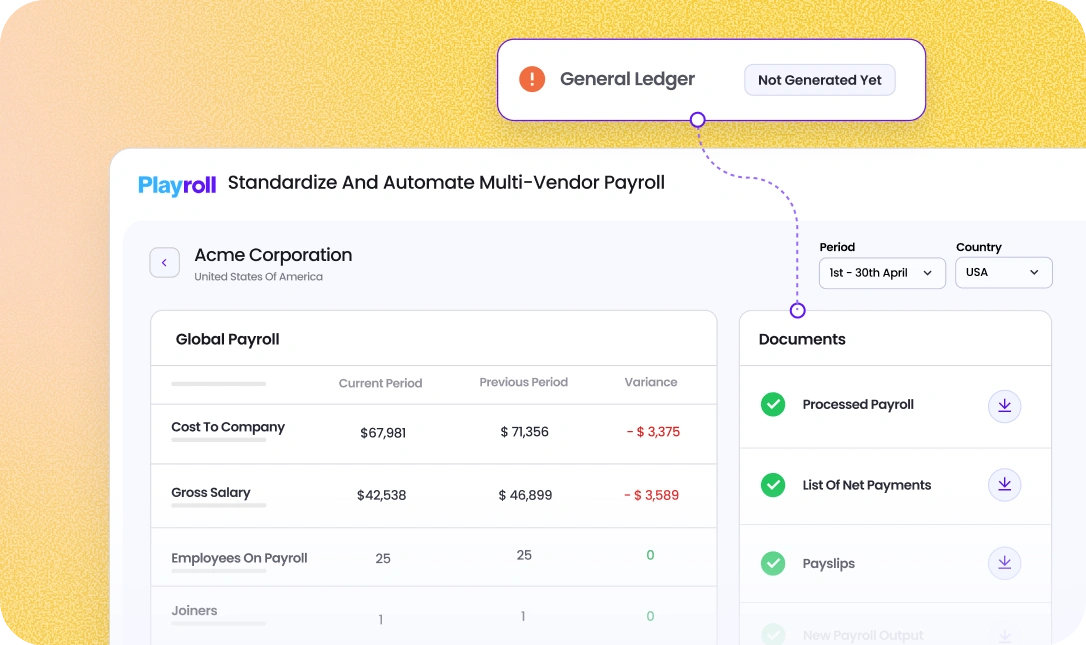

To set up payroll processing in California, you first register your business with the California Employment Development Department to obtain a state employer payroll tax account number, then collect Forms W‑4 and DE 4 from each employee so you can calculate federal and California income tax withholding correctly. You must configure your payroll system to track daily and weekly overtime, local minimum wage rates, state disability insurance and unemployment insurance contributions, and then file required state and federal returns and deposits on the prescribed schedules.

How does an Employer of Record help you hire in California?

.png)

An Employer of Record helps you hire in California by acting as the legal employer for state purposes, registering for California payroll taxes, running compliant payroll, and issuing wage statements that meet strict state requirements. They also handle onboarding documents, required state notices, benefits aligned with California law, and ongoing compliance with overtime, paid sick leave, and termination rules while you manage the employee’s work and performance.

Is there a minimum wage requirement for employees in California?

.png)

Yes, California does have a minimum wage requirement. As of January 1, 2026, the statewide minimum wage is $16.90 per hour for all employers. Some cities and counties set higher local minimum wages, and if those rates are more favorable to the employee, they must be followed instead. When employing people in California, it’s important to keep an eye on both state and local wage ordinances and adjust pay promptly whenever a new minimum wage takes effect.

How much does it cost to employ someone in California?

.png)

The cost to employ someone in California includes their gross wages, which must at least meet the applicable state or local minimum wage, plus employer payroll taxes such as Social Security, Medicare, federal and California unemployment insurance, and any benefits you offer like health insurance or retirement contributions. You should also budget for mandatory paid sick leave, potential higher local wage rates, workers’ compensation premiums, and administrative costs for complying with California’s detailed labor and tax rules.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)