Classifying Your Workers Correctly

In Colorado, you must correctly distinguish employees from independent contractors under both IRS rules and the Colorado Department of Labor and Employment (CDLE) tests. The IRS focuses on behavioral control, financial control, and the overall relationship, while Colorado also looks at whether the worker is free from control and engaged in an independent trade.

If you misclassify workers, your company can face back wages, unpaid overtime, taxes, interest, and civil penalties, and may be liable for unpaid unemployment and workers’ compensation premiums. You should document contractor relationships with written agreements and review misclassification guidance before hiring.

Verify Employee Work Eligibility

For every employee you hire in Colorado, you must complete federal Form I-9 within 3 business days of the employee’s start date. You must physically or remotely inspect acceptable identity and work authorization documents, such as a U.S. passport or a combination of driver’s license and Social Security card.

Colorado does not currently mandate E-Verify for most private employers, but you may choose to use it voluntarily if you apply it consistently. You must retain I-9s for the longer of 3 years after the hire date or 1 year after termination and store them separately from general personnel files so you can produce them quickly in an audit.

Create an Employee Onboarding Process

Your onboarding process in Colorado should include a written offer letter, collection of federal Form W-4 and any applicable state withholding form, and bank details for direct deposit if the employee opts in. You should also provide your employee handbook, obtain signed acknowledgments of key policies, and issue required state notices such as wage information and workers’ compensation coverage details.

Make sure you set up each new hire in your payroll and timekeeping systems before their first day so you can track hours, overtime, and leave accurately. Clear documentation at onboarding will give you better visibility into total hiring costs and reduce compliance risk over the life of the employment relationship.

Pay Frequency & Methods

Colorado law generally requires you to pay employees at least once a month or every 30 days, with regular paydays disclosed in writing at hire. If you terminate an employee, you must pay all earned wages immediately if you initiate the discharge, or by the next regular payday if the employee resigns, and late payment can trigger statutory penalties on unpaid amounts.

Payment Methods (How You Can Pay)

Your company can choose among several payment methods in Colorado, but you must always ensure employees receive full wages on time and receive an accurate written pay statement each pay period.

- Payroll Check: You can pay employees by check as long as it is payable at full face value in cash at a bank without fees to the employee.

- Cash: You may pay wages in cash, but you must still provide a detailed wage statement showing hours, rates, deductions, and net pay.

- Direct Deposit (EFT): You can offer direct deposit, but participation must be voluntary and you must obtain the employee’s written or electronic consent.

- Paycards: You may use paycards if employees can access full wages at least once per pay period without fees and you clearly disclose terms and access locations.

- Outsourced Payroll: You can outsource payroll to a third-party provider, but your company remains legally responsible for accurate, timely wage payments and tax remittances.

When you hire employees in Colorado, you must withhold and remit federal and state payroll taxes and pay several employer-only contributions. You will need accounts with the Colorado Department of Revenue and the Colorado Department of Labor and Employment before you run your first payroll.

Employer Tax Contributions

As a Colorado employer, you are responsible for federal Social Security and Medicare contributions, federal unemployment tax (FUTA), and state unemployment insurance (SUI). You may also have to contribute to local taxes or state-run programs if applicable to your workforce.

Employee Payroll Tax Contributions

Your company must withhold federal and Colorado state income tax, the employee share of Social Security and Medicare, and any required state program contributions from each paycheck. You also need to provide employees with year-end Forms W-2 summarizing their wages and withholdings.

Minimum Wage in Colorado

Colorado sets its own minimum wage, which is higher than the federal rate and is adjusted annually for inflation. You must pay at least the state minimum to most non-exempt employees, and certain localities such as Denver may impose even higher local minimum wages that your company must follow when applicable.

Working Hours in Colorado

State law does not cap the total hours adults may work in a day or week, but you must pay overtime when thresholds are exceeded and comply with rest and meal break rules. Under Colorado Overtime and Minimum Pay Standards (COMPS), most employees are entitled to a 10-minute paid rest break for every 4 hours worked and an uninterrupted 30-minute meal period for shifts over 5 hours.

Overtime in Colorado

Colorado requires you to pay overtime at 1.5 times the employee’s regular rate when they work more than 40 hours in a workweek, more than 12 hours in a workday, or more than 12 consecutive hours, whichever yields more overtime pay. Only employees who meet specific salary and duties tests under federal and state law may be treated as exempt from overtime, so you should review classifications regularly.

In Colorado, offering a competitive benefits package helps you attract talent while staying compliant with federal laws like the Affordable Care Act (ACA) and state-specific programs. If you average 50 or more full-time employees, you must offer ACA-compliant health coverage or face potential federal penalties, and many smaller employers still provide health, retirement, and supplemental benefits to remain competitive.

Mandatory Leave Policies in Colorado

Paid Time Off in Colorado

Colorado does not require general vacation or PTO, but once your company offers it, your policy and state law govern how it accrues and is paid out. Colorado treats accrued vacation as earned wages, so you generally cannot implement “use-it-or-lose-it” forfeiture and must pay out unused balances at separation according to your written policy.

You should clearly define accrual rates, caps, and carryover rules in your handbook and ensure your payroll system tracks PTO balances accurately. Transparent PTO practices help you manage staffing while avoiding wage disputes over earned but unused time.

Maternity & Paternity Leave in Colorado

Employees in Colorado may qualify for unpaid, job-protected maternity and paternity leave under the federal FMLA if your company meets the coverage threshold and the employee meets service and hours requirements. Colorado’s FAMLI program also provides paid benefits for bonding with a new child, funded through payroll premiums shared by employers and employees.

Your company should coordinate FMLA, FAMLI, and any employer-sponsored parental leave so employees understand how pay, benefits, and job protection interact. Clear written procedures and early communication with expecting parents will help you plan coverage while staying compliant.

Sick Leave in Colorado

Under the Healthy Families and Workplaces Act, most Colorado employers must provide paid sick leave that employees can use for their own illness, a family member’s health needs, or certain safety-related reasons. Employees accrue leave at a statutory minimum rate per hours worked, up to a defined annual cap, and you must track accrual and usage on an ongoing basis.

Your company must also allow sick leave carryover up to the statutory limit and cannot retaliate against employees for using their entitled time. You should update your policies and payroll systems to reflect Colorado’s specific accrual, notice, and documentation rules.

Military Leave in Colorado

Colorado employers must comply with federal USERRA protections, which require you to grant unpaid leave for qualifying military service and reinstate eligible employees to their positions with preserved benefits. State law may provide additional protections for members of the National Guard or state defense forces when they are called to duty.

You should request and retain appropriate military orders, maintain benefit continuation as required, and ensure managers understand that you cannot penalize employees for military service. Having a clear military leave policy will help you respond consistently when employees are called to serve.

Jury Duty in Colorado

In Colorado, you must allow employees time off to serve on a jury and may not discipline or terminate them for complying with a summons. For certain full-time employees, you are required to provide limited paid leave for jury service, typically covering a set number of days at the employee’s regular wage.

Your policy should explain how employees should notify you of jury duty, how to provide proof of service, and how pay will be handled. Make sure supervisors understand they cannot pressure employees to avoid or postpone jury service in violation of state law.

Voting Leave in Colorado

Colorado law requires you to provide employees with paid time off to vote, generally up to a specified number of hours, if they do not have sufficient time to vote outside of working hours. You may choose the time of day the employee is released, but it should not interfere with their ability to cast a ballot.

Include voting leave procedures in your handbook and remind managers during election periods so they approve requests consistently. Proper planning will minimize disruption while ensuring your company meets its civic and legal obligations.

Bereavement Leave in Colorado

Colorado does not mandate bereavement leave, but many employers voluntarily provide paid or unpaid time off following the death of a close family member. If your company offers bereavement leave, the terms in your written policy will control eligibility, duration, and pay.

Clearly defining who qualifies as a family member and how much leave is available will help you administer requests fairly. Offering compassionate bereavement leave can support employee well-being and strengthen retention, even though it is not legally required.

Termination Process

Colorado is an at-will employment state, so you may generally terminate employment at any time for lawful, non-discriminatory reasons, but you must still follow your own policies and any contract terms. Documenting performance issues, providing final pay correctly, and giving required notices will reduce the risk of wrongful termination or wage claims.

Notice Period

Colorado law does not require a general notice period before termination or resignation, unless you have agreed to one in an employment contract or collective bargaining agreement. However, you must comply with final wage timing rules, and providing reasonable notice can help you transition work and protect business continuity.

Severance

Severance pay is not required under Colorado law, but many employers offer it in layoffs or negotiated separations in exchange for a release of claims. If you provide severance, you should document the terms in a written agreement, ensure any release complies with federal and state law, and pay all earned wages separately from severance amounts.

How do you set up payroll processing in Colorado?

.png)

To set up payroll processing in Colorado, you first need to register your business with the Colorado Department of Revenue for state income tax withholding and with the Colorado Department of Labor and Employment for unemployment insurance. Then you should collect Form W-4 and any state withholding forms from employees, configure your payroll system to apply Colorado minimum wage, overtime, paid sick leave, and FAMLI rules, and establish a regular pay schedule that meets the state’s at-least-monthly requirement while ensuring timely tax deposits and filings.

How does an Employer of Record help you hire in Colorado?

.png)

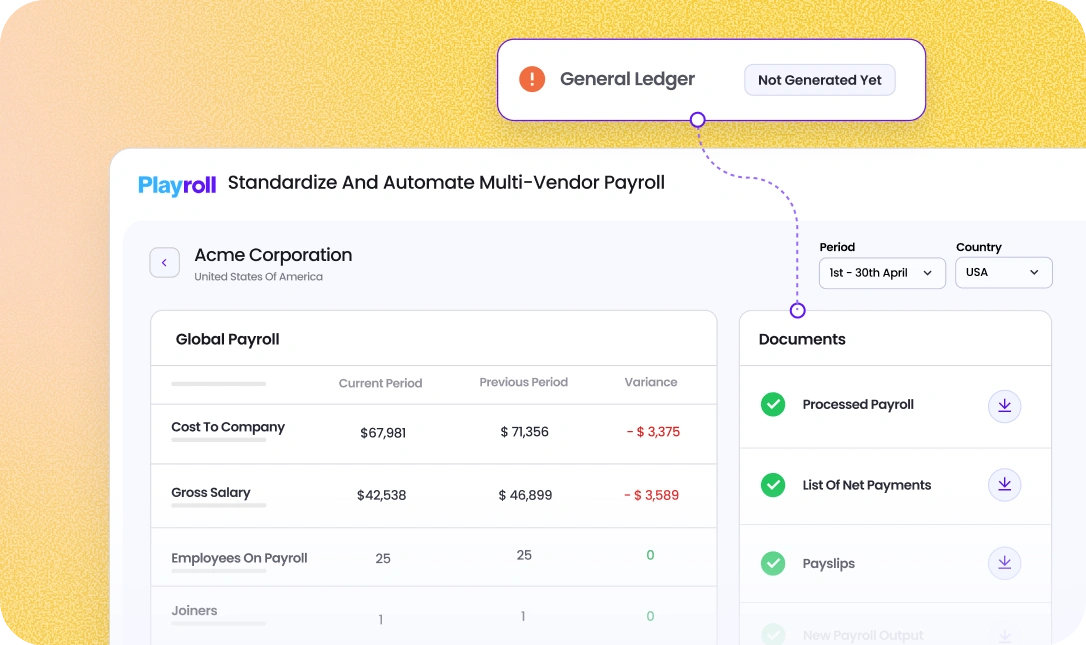

An Employer of Record helps you hire in Colorado by acting as the legal employer for your local staff, so you do not need to open a Colorado entity or register for multiple state tax accounts. The EOR handles compliant employment contracts, payroll, tax withholding, unemployment and FAMLI contributions, and required benefits and notices under Colorado law, while you manage the employee’s role, performance, and day-to-day responsibilities.

Is there a minimum wage requirement for employees in Colorado?

.png)

Yes, there is a minimum wage requirement for employees in Colorado, and it is higher than the federal minimum wage and adjusted annually for inflation. Your company must pay at least the current Colorado minimum wage to most non-exempt employees, and if a city like Denver sets a higher local minimum, you must follow the higher rate for employees working in that jurisdiction.

How much does it cost to employ someone in Colorado?

.png)

The cost to employ someone in Colorado includes more than just their gross salary or hourly wages, because you must also budget for employer payroll taxes, state unemployment insurance, FAMLI premiums, workers’ compensation insurance, and any health, retirement, or other benefits you offer. You should also factor in paid sick leave, potential overtime under Colorado’s stricter rules, and administrative costs for compliance and payroll processing to understand the true total cost of a Colorado hire.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)