Classifying Your Workers Correctly

Your company must distinguish properly between employees and independent contractors under IRS common law tests and Vermont’s wage and hour rules. You’ll look at behavioral control, financial control, and the overall relationship to decide if someone is truly independent. Vermont can hold you liable for back wages, unpaid overtime, taxes, interest, and civil penalties if you misclassify workers.

You should document why each role is employee or contractor status and review classifications whenever job duties change. To reduce risk, compare your practices with federal guidance and resources such as Playroll's misclassification guide and seek legal advice before using large numbers of contractors.

Verify Employee Work Eligibility

For every new hire in Vermont, you must complete federal Form I-9 within 3 business days of the employee’s start date. You’ll need to physically inspect original identity and work authorization documents from the Lists of Acceptable Documents and keep I-9s for the longer of 3 years after hire or 1 year after termination. Vermont does not mandate E-Verify for most private employers, but you may opt in if it suits your compliance program.

Store I-9s separately from personnel files and be consistent in how you request documents to avoid discrimination claims. If you use E-Verify voluntarily, you must follow federal program rules, including timely case creation and handling tentative nonconfirmations.

Create an Employee Onboarding Process

In Vermont, your onboarding should include a written offer letter outlining pay, hours, and at-will status, plus collection of federal Form W-4 and Vermont Form W-4VT for income tax withholding. You should also gather direct deposit details, obtain signed acknowledgments of your employee handbook and policies, and provide any required state notices, such as wage rate information and workers’ compensation postings.

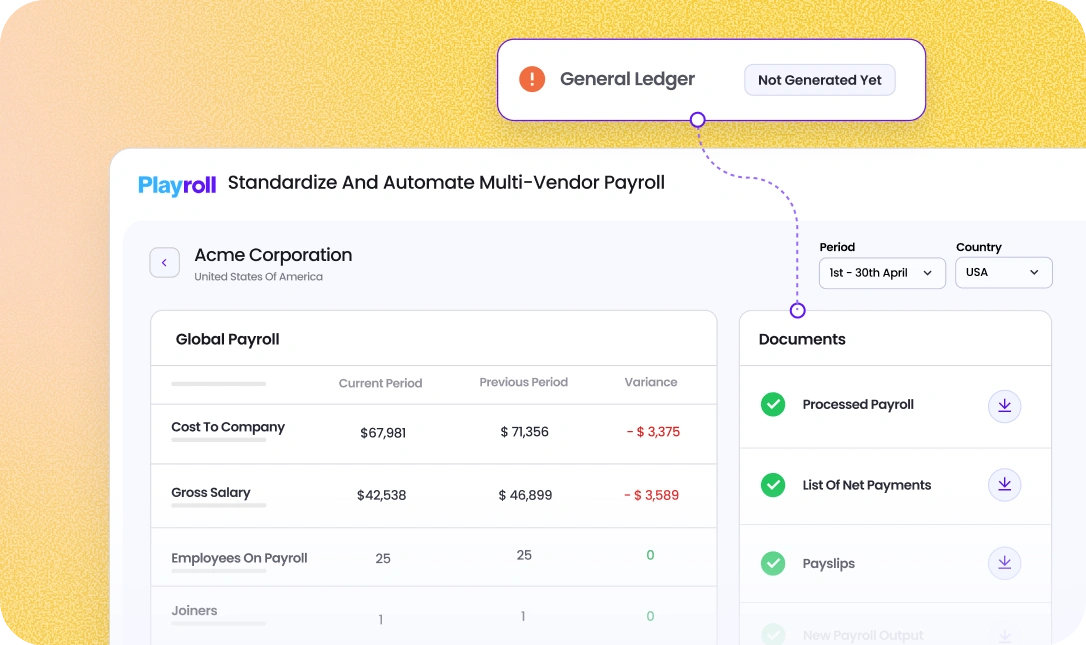

Build a repeatable checklist so every Vermont hire receives the same compliant experience and understands your expectations from day one. If you use Playroll, you’ll also gain clear visibility into total hiring costs in Vermont before you extend an offer.

Pay Frequency & Methods

Vermont generally requires you to pay wages weekly, but you may pay biweekly or semimonthly if you obtain approval from the Vermont Department of Labor. You must establish regular paydays and pay all wages earned up to that date, and final wages are typically due on the next regular payday or within 72 hours if the employee is discharged. Failure to pay on time can expose your company to wage claims, penalties, and attorney’s fees.

One introductory paragraph written to the reader.

- Payroll Check: You can pay Vermont employees by check as long as it is payable at full face value and employees can access funds without fees.

- Cash: You may pay wages in cash in Vermont, but you must still provide an accurate written wage statement showing hours, rates, and deductions.

- Direct Deposit (EFT): You can offer direct deposit in Vermont only on a voluntary basis and must obtain each employee’s written or electronic consent.

- Paycards: You may use paycards if employees have fee-free access to their full wages and you clearly disclose terms and withdrawal options.

- Outsourced Payroll: You can outsource payroll to a third-party provider, but your company remains responsible for Vermont wage, tax, and recordkeeping compliance.

When you hire in Vermont, you must handle both employer and employee payroll tax obligations under federal and state law. You’ll register with the Vermont Department of Taxes and the Vermont Department of Labor to withhold income tax, pay unemployment insurance, and file required returns on time.

Employer Tax Contributions

As an employer, you’ll pay Vermont unemployment insurance and your share of federal payroll taxes, and you may owe additional local obligations depending on your operations. You must obtain a Vermont Business Tax Account and file periodic wage reports and tax payments electronically where required.

Employee Payroll Tax Contributions

You must withhold Vermont state income tax and federal income tax from employee wages, along with the employee portions of Social Security and Medicare. Your company is responsible for depositing these amounts and filing federal and Vermont withholding returns on the required schedule.

Minimum Wage in Vermont

As of 2025, Vermont’s minimum wage is $13.67 per hour for most non-exempt employees, higher than the federal minimum. You must pay at least this rate, with limited exceptions for certain tipped employees and specific training situations, and you should monitor annual adjustments tied to inflation.

Working Hours in Vermont

Vermont does not cap the number of hours adults may work in most private-sector jobs, but you must pay for all hours suffered or permitted to work. You should track hours accurately, schedule reasonable rest periods, and comply with any industry-specific rules that apply to your operations.

Overtime in Vermont

Vermont follows the federal Fair Labor Standards Act, so you must pay at least 1.5 times the employee’s regular rate for all hours worked over 40 in a workweek for non-exempt staff. Certain employees may qualify for exemptions, but you must carefully apply the duties and salary tests before treating a role as exempt from overtime.

In Vermont, offering a competitive benefits package helps you attract talent while staying compliant with federal rules like the Affordable Care Act if you have 50 or more full-time employees. You should balance required benefits such as workers’ compensation with voluntary offerings like health insurance, retirement plans, and paid time off to stay competitive in the regional labor market.

Mandatory Leave Policies in Vermont

Paid Time Off in Vermont

Vermont does not require general vacation or PTO, but once your company offers it, you must follow your written policy and any promises made to employees. Many Vermont employers combine vacation, personal days, and sick time into a single PTO bank to simplify administration and remain competitive.

You should clearly state accrual rates, carryover rules, and payout practices at termination in your handbook. Transparent PTO policies help you avoid wage disputes and support predictable staffing coverage.

Maternity & Paternity Leave in Vermont

Under Vermont’s Parental and Family Leave Act, eligible employees of covered employers may take up to 12 weeks of unpaid, job-protected leave for the birth or adoption of a child. This state protection works alongside the federal FMLA for employers with 50 or more employees, which can provide overlapping rights.

Your company should coordinate these unpaid leaves with any available paid benefits, such as accrued PTO or short-term disability insurance. Make sure your policies explain eligibility, notice requirements, and how benefits like health insurance continue during leave.

Sick Leave in Vermont

Vermont’s Earned Sick Time law generally requires you to provide paid sick leave that employees accrue based on hours worked, up to a state-defined annual limit. Employees can typically use this time for their own illness, to care for a family member, or for certain safety-related reasons.

You must track accruals, allow use after any waiting period permitted by law, and include sick time balances on wage statements or in an accessible system. Clear written rules on increments of use and call-in procedures will help your managers apply the law consistently.

Military Leave in Vermont

Employees in Vermont who serve in the National Guard or armed forces are protected by federal USERRA and state law, which require you to grant unpaid leave for qualifying service. You must reinstate returning service members to the same or an equivalent position with the same seniority, status, and pay, subject to statutory conditions.

Your company should maintain benefits as required during military leave and avoid any adverse action based on an employee’s service obligations. Train supervisors so they understand scheduling flexibility and reemployment rights for Guard and Reserve members.

Jury Duty in Vermont

Vermont law requires you to allow employees time off to serve on a jury and prohibits disciplining or firing them for fulfilling this civic duty. You are not generally required to pay employees for time spent on jury service unless your policy or contract promises otherwise.

Ask employees to provide their jury summons and coordinate schedules so you can plan coverage while they are away. If you choose to pay for some or all jury time, describe the arrangement clearly in your handbook.

Voting Leave in Vermont

Vermont encourages voting access, and many employers voluntarily provide flexibility so employees can vote during early voting periods or on Election Day. While state law does not mandate a specific amount of paid voting leave for most private employers, rigid schedules that effectively prevent voting can create employee relations issues.

You can support participation by allowing schedule adjustments, remote work, or short unpaid breaks to reach the polls. Communicating your expectations in advance of major elections helps avoid confusion.

Bereavement Leave in Vermont

Vermont does not require private employers to provide bereavement leave, but many companies offer a few days of paid or unpaid time off after the death of an immediate family member. Providing this benefit can support employee well-being and morale during difficult times.

If you offer bereavement leave, define who qualifies as family, how much time is available, and any documentation you may request. Consistent application of your policy will help prevent perceptions of unfair treatment.

Termination Process

Vermont is generally an at-will employment state, meaning you or the employee can end the relationship at any time for any lawful reason. Even so, you should document performance issues, follow your disciplinary procedures, and avoid discriminatory or retaliatory motives to reduce the risk of wrongful termination claims.

Notice Period

Vermont law does not require a specific notice period for individual terminations, but large layoffs or plant closings may trigger federal WARN Act obligations if you meet size thresholds. Many employers choose to give some notice or pay in lieu of notice as a best practice, especially for long-serving employees.

Severance

Severance pay is not mandated in Vermont, but you may offer it under a company policy or individual agreement to ease transitions and obtain a release of claims. If you provide severance, apply your criteria consistently and ensure any release complies with federal and state requirements, especially for older workers.

How do you set up payroll processing in Vermont?

.png)

To set up payroll processing in Vermont, you first register for a Vermont Business Tax Account with the Vermont Department of Taxes and an unemployment insurance account with the Vermont Department of Labor, then obtain federal EIN credentials if you do not already have them. Next, you configure your payroll system to withhold Vermont state income tax, calculate unemployment insurance, and apply the current $13.67 minimum wage and overtime rules, and you establish regular pay periods, timekeeping, and record retention practices that comply with Vermont law.

How does an Employer of Record help you hire in Vermont?

.png)

An Employer of Record helps you hire in Vermont by acting as the legal employer for your local staff, handling Vermont payroll, state income tax withholding, unemployment insurance, and workers’ compensation on your behalf. You direct the employee’s day-to-day work while the EOR manages compliant contracts, onboarding, benefits, and terminations under Vermont and federal law, allowing you to operate quickly without forming a Vermont entity.

Is there a minimum wage requirement for employees in Vermont?

.png)

Yes, there is a minimum wage requirement for employees in Vermont, and as of 2025 most non-exempt workers must be paid at least $13.67 per hour, which is higher than the federal minimum wage. Your company must monitor annual adjustments, apply the Vermont rate to all covered employees working in the state, and ensure tipped and exempt employees are treated according to Vermont’s specific rules.

How much does it cost to employ someone in Vermont?

.png)

The cost to employ someone in Vermont includes their gross wages at or above the $13.67 state minimum wage, plus employer payroll taxes such as Social Security, Medicare, federal and Vermont unemployment insurance, and the cost of any benefits you offer like health insurance or retirement contributions. You should also budget for paid sick time required under Vermont’s Earned Sick Time law, potential PTO or holiday pay, and administrative costs for payroll, HR, and compliance when estimating total employment cost in Vermont.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)