Classifying Your Workers Correctly

Your company must distinguish properly between employees and independent contractors using the IRS common law control test and federal guidance, since Tennessee generally follows federal definitions. You should look at who controls how work is done, who provides tools, and whether the worker can realize profit or loss. Misclassification can trigger back wages, unpaid overtime, tax liabilities, interest, and penalties at both federal and state levels.

When you are unsure, you can review IRS resources or seek a determination rather than guessing. If you misclassify Tennessee workers, you may owe retroactive unemployment insurance contributions and face liability under federal wage and hour law – this guide can help.

Verify Employee Work Eligibility

For every Tennessee employee you hire, you must complete federal Form I-9 within 3 business days of the employee’s start date to verify identity and work authorization. You must review original acceptable documents from List A, or a combination of List B and List C, and you must retain I-9s for the longer of 3 years after hire or 1 year after termination. Tennessee requires most private employers with 35 or more employees to use E-Verify, and smaller employers may use E-Verify or retain certain identity and work authorization documents.

Your company should store I-9 and E-Verify records securely and separately from personnel files, and be prepared to produce them in the event of a federal or state audit. Make sure your hiring managers are trained not to request specific documents or treat non‑citizens differently, to avoid discrimination claims.

Create an Employee Onboarding Process

When onboarding employees in Tennessee, you should issue a clear written offer letter outlining pay rate, pay schedule, exemption status, and key benefits. You will need to collect federal Form W‑4, any applicable direct deposit authorization, and signed acknowledgments for your employee handbook and key policies such as anti‑harassment and confidentiality. Tennessee employers must also report all new hires to the Tennessee New Hire Reporting Program within 20 days of hire.

Build a repeatable checklist that includes required federal posters, any safety training, and benefit enrollment so every Tennessee hire receives the same compliant experience. As you design your onboarding, keep visibility into total hiring costs – wages, taxes, benefits, and tools – so you can budget accurately for each new role.

Pay Frequency & Methods

In Tennessee, you must pay employees at least twice per month, and regular paydays must be established in advance and communicated in writing. If you terminate an employee, you must pay all wages due on the next regularly scheduled payday, whether the separation is voluntary or involuntary. Failure to pay on time can expose your company to wage claims, potential liquidated damages, and attorney’s fees under state law.

Payment Methods (How You Can Pay)

Your company can choose from several payment methods in Tennessee, but you must always ensure employees receive their full wages on time and a clear wage statement showing hours, rates, and deductions.

- Payroll Check: You may pay by check as long as employees can cash it at full face value without fees and receive an itemized pay stub.

- Cash: You can pay wages in cash, but you must document each payment and provide a written wage statement so employees can verify their earnings and deductions.

- Direct Deposit (EFT): You may use direct deposit with an employee’s written consent, and you must offer an alternative method for anyone who declines.

- Paycards: You can pay by payroll card if employees have fee‑free access to their full wages at least once per pay period and receive clear disclosures of any card fees.

- Outsourced Payroll: You may outsource payroll to a third‑party provider, but your company remains responsible for accurate wage payments, filings, and recordkeeping.

When you hire employees in Tennessee, you must handle federal payroll taxes plus state unemployment insurance, even though Tennessee does not tax regular wage income. You will need to register with the appropriate state agencies, calculate and withhold the correct amounts each pay period, and file returns and remit payments on strict deadlines.

Employer Tax Contributions

Your company is responsible for employer‑side federal taxes and Tennessee unemployment insurance contributions. You must register with the Tennessee Department of Labor and Workforce Development for unemployment and with the Tennessee Department of Revenue if you are subject to other state business taxes.

Employee Payroll Tax Contributions

You must withhold federal income tax and the employee share of FICA from Tennessee employees’ pay, even though the state does not impose a wage income tax. Your company must remit these withholdings on the correct federal schedule and provide employees with Form W‑2 after year‑end.

Minimum Wage in Tennessee

Tennessee does not set its own minimum wage, so your company must follow the federal minimum wage of $7.25 per hour under the Fair Labor Standards Act. You should still review local market rates, because paying only the minimum can make it harder to attract and retain talent in competitive areas.

Working Hours in Tennessee

Working hours and scheduling in Tennessee are largely governed by federal law, which does not cap the number of hours adults can work in a week as long as overtime rules are followed. You should track all hours worked for non‑exempt employees, provide required meal or rest breaks if promised by policy or contract, and comply with youth employment restrictions for minors.

Overtime in Tennessee

Tennessee follows federal overtime rules, requiring that non‑exempt employees receive at least 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. Your company must correctly determine exempt versus non‑exempt status based on job duties and salary thresholds, not job titles alone, and maintain accurate time records to defend against wage claims.

In Tennessee, you must comply with federal benefit laws such as the Affordable Care Act, which requires applicable large employers with 50 or more full‑time employees to offer affordable health coverage or face potential penalties. Beyond legal minimums, offering competitive benefits like health insurance, retirement plans, and paid time off can help your company stand out in a tight labor market.

Mandatory Leave Policies in Tennessee

Paid Time Off in Tennessee

Tennessee does not require private employers to provide paid vacation or general PTO, so you can design your own policy. If you choose to offer PTO, clearly state in writing how it accrues, when it can be used, and whether unused time is paid out at termination. Consistent application of your policy is important to avoid discrimination or wage disputes.

Maternity & Paternity Leave in Tennessee

Parental leave in Tennessee is primarily governed by federal FMLA, which can provide up to 12 weeks of unpaid, job‑protected leave for eligible employees of covered employers. Tennessee law may provide additional protections for pregnancy‑related conditions, including reasonable accommodations such as modified duties or schedules. Since there is no state‑mandated paid parental leave, many employers choose to offer paid maternity or paternity benefits to remain competitive.

Sick Leave in Tennessee

Tennessee does not mandate paid sick leave for private employers, but you must follow your own written policies and any obligations under federal laws such as the Americans with Disabilities Act. You should define what qualifies as sick leave, whether a doctor’s note is required, and any carryover rules. Offering at least a modest bank of paid sick time can reduce presenteeism and support workplace health.

Military Leave in Tennessee

Employees in Tennessee who serve in the U.S. armed forces, reserves, or National Guard are protected by federal USERRA and state law, which generally require you to grant unpaid leave for service and training. You must reinstate eligible employees to the same or a comparable position upon timely return, with preserved seniority and benefits as required by law. Make sure managers understand they cannot retaliate against employees for taking military leave.

Jury Duty in Tennessee

Your company must allow employees time off to serve on a jury in Tennessee and may not discipline or terminate them for complying with a summons. State law does not require private employers to pay for this time, but if you choose to do so, your policy should explain the amount and duration of paid jury leave. You can request proof of service, such as a court notice or attendance slip.

Voting Leave in Tennessee

Tennessee law generally entitles employees to up to 3 hours off work to vote if their work schedule does not provide at least 3 consecutive non‑working hours while the polls are open. You may require employees to request this leave before election day and can specify when during the workday the leave is taken. If the statutory conditions are met, you must provide this voting leave with pay and cannot penalize employees for using it.

Bereavement Leave in Tennessee

Tennessee does not require private employers to offer bereavement leave, paid or unpaid, so any such leave is governed by your internal policy. Many employers provide a few days of paid leave for the death of an immediate family member as a matter of compassion and retention. Whatever you decide, document the policy clearly and apply it consistently across your Tennessee workforce.

Termination Process

Tennessee is an at‑will employment state, so you or the employee may generally end the relationship at any time for any lawful reason, or no reason, as long as it is not discriminatory or retaliatory. You should still follow a consistent process that includes documenting performance issues, collecting company property, and providing final pay and benefits information to reduce legal risk.

Notice Period

Tennessee law does not require you to provide advance notice of termination or for employees to give notice before resigning, unless a contract or collective bargaining agreement says otherwise. Even though notice is not legally mandated, many employers use a standard two‑week notice expectation for resignations as a matter of policy and professionalism.

Severance

Severance pay is not required under Tennessee law, so whether you offer it is a business decision or a matter of contract. If you provide severance, you should use a written agreement that clearly states the amount, payment timing, and any conditions such as a release of claims. Be sure to comply with federal rules on releases, especially for employees over age 40.

How do you set up payroll processing in Tennessee?

.png)

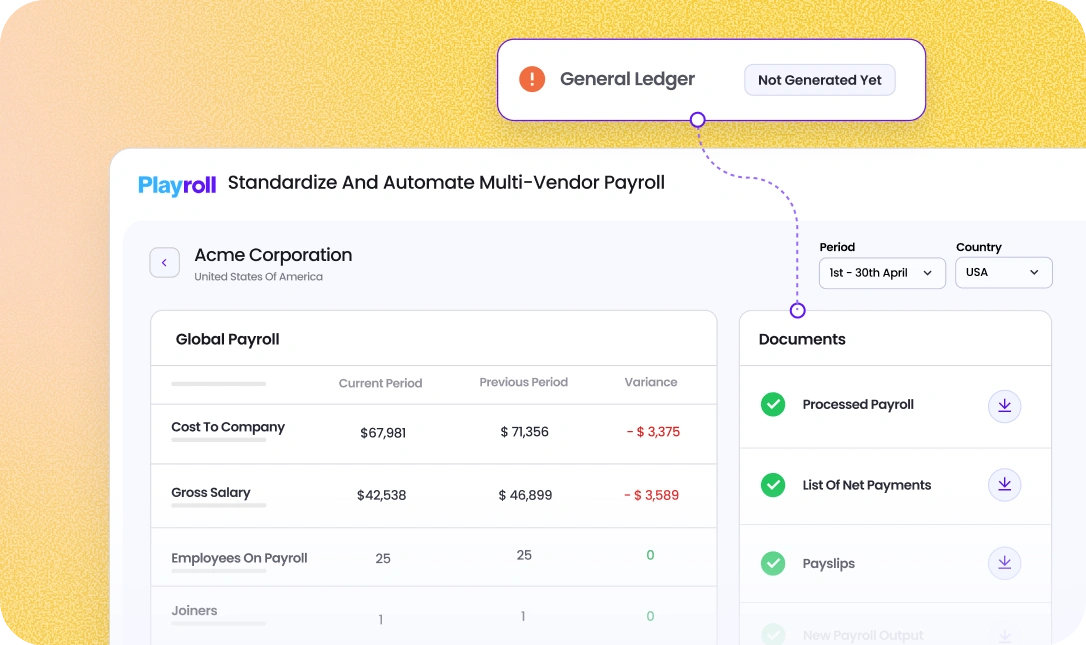

To set up payroll processing in Tennessee, you first obtain a federal EIN and register with the Tennessee Department of Labor and Workforce Development for unemployment insurance, and with the Tennessee Department of Revenue if other state business taxes apply. Then you choose a pay frequency that meets Tennessee’s requirement of at least semimonthly, implement a system to track hours, calculate federal taxes and state unemployment, and ensure employees are paid on the established payday with clear wage statements.

How does an Employer of Record help you hire in Tennessee?

.png)

An Employer of Record helps you hire in Tennessee by acting as the legal employer for your local staff, handling payroll, unemployment insurance, and federal tax withholdings while you manage daily work. This lets you onboard Tennessee employees quickly without opening a local entity, and reduces compliance risk around contracts, wage payments, and required notices.

Is there a minimum wage requirement for employees in Tennessee?

.png)

Yes, there is a minimum wage requirement for employees in Tennessee, but it comes from federal rather than state law because Tennessee has no separate state minimum wage. You must pay at least the federal minimum wage of $7.25 per hour to non‑exempt employees, and you should also follow federal overtime rules for hours worked over 40 in a workweek.

How much does it cost to employ someone in Tennessee?

.png)

The cost to employ someone in Tennessee includes the employee’s gross wages, the employer share of Social Security and Medicare, federal and state unemployment insurance contributions, and any benefits you choose to offer such as health insurance or retirement plans. You should also budget for indirect costs like payroll processing, equipment, and training, which can add 15–30% or more on top of base salary depending on your Tennessee benefits package and tax rates.

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)