Copied to Clipboard

Ready to get Started?

Key Takeaways

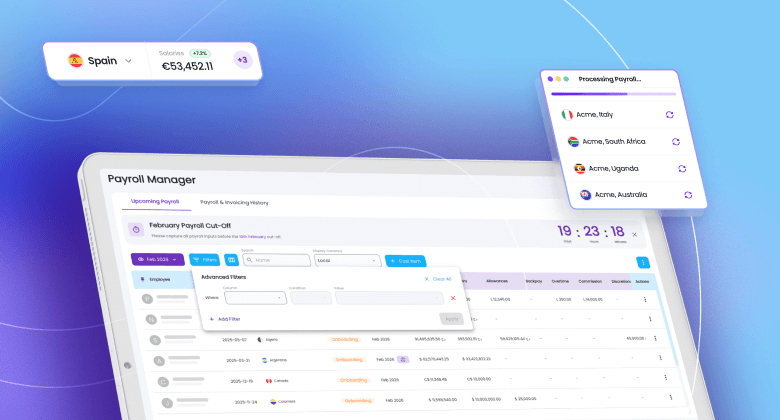

Paying international employees can be as much of a challenge as the actual payroll process. Cross-border payments are very slow and expensive when issued as SWIFT payments. Plus, legal requirements make it mandatory in some countries to pay employees from a local bank account, which increases the admin work behind the payment system.

What aspects do businesses have to keep in mind when paying overseas employees? How to pay international employees accurately, on time, and compliantly?

What are the challenges of paying international employees?

Many businesses with global operations are unsure about how to pay foreign employees. That’s because there are many restrictions, pitfalls and complications organizations need to work around. The challenges of paying global employees include:

- Complying with compensation laws

- Choosing the correct payroll cycle

- Respecting the pay dates required by law

- Handling different currencies

- Developing fair compensation standards for the entire global team

- Finding a cost-effective way for cross-border payments

- Withholding the right amount of payroll taxes

- Avoiding employee misclassification

That's why many businesses looking to hire talent in international markets turn to Employer of Record solutions, such as Playroll, to hire talent internationally compliantly and securely.

Which currency should you use when paying international employees?

When thinking about how to pay employees working across international borders, one of the first questions that usually comes up is which currency to use. Unless the organization and the employee are both based in countries using the euro, they are likely to use different currencies.

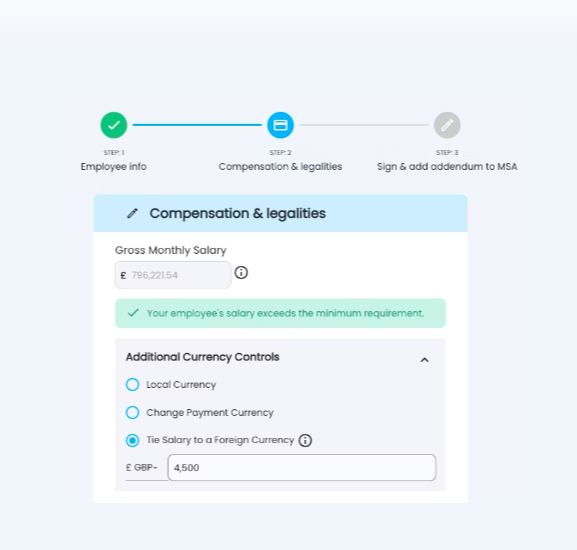

So, which currency to use for paying the employee’s salary? The one used in the employee’s country of residence, or the one that is used in the jurisdiction where the employer is based?Depending on the country, it is possible to offer compensation in a non-local currency to EOR employees with active contracts directly on the Playroll platform - providing employers flexibility as well as, competitiveness when attracting top talent.

What’s more, many countries require employees to be paid in the local currency, which means that employers have no choice but to pay in foreign currency. For example, when hiring a remote employee in India, the salary indicated in the employment contract needs to be given in Rupees.

Which payroll set-up for paying international employees is for you?

Payroll taxes usually have to be withheld and paid in the country from where the employee works, which means that the employer needs to have a compliant payroll set-up in the respective jurisdiction. The different options employers have to set up payroll for international employees include:

- Creating a local legal entity

- Registering as a foreign employer

- Hiring employees through an Employer of Record

- Establishing a shadow payroll

- Working with independent contractors

- Outsourcing payroll to a payroll provider who also handles employee payment

3 ways to pay employees through Playroll

Flexibility is crucial when it comes to global salary payments. Different countries have different payment and tax rules and regulations as well as currencies of varying strengths in the global landscape. By offering employees payment in non-local currencies employers can become more competitive in both retaining and acquiring talent.

Playroll supports 3 contractual payment methods, including:

- Local Currency Payments

- Pegged Salary Payments* (these can be pegged to foreign currencies but paid in local currencies OR fixed to local currencies with variance based on exchange rates)

- Payments in Foreign Currencies* (these are variable based on exchange rates)

Note, these options vary by regional allowances, and we will add more countries overtime. For more details or if you're looking for regional support not listed below, do reach out to a local representative at Playroll.

In what countries is non-local currency salary payments offered?

Playroll enables employers to offer pegged Salary with an allowance adjustment in all supported territories 🌍.

For territories where foreign currency amounts can be quoted on employment agreements, no allowance adjustments are required, this is run monthly based on the direct FX rate. This is only available in approved markets, listed below:

- Nigeria 🇳🇬

- Uganda 🇺🇬

- Kenya 🇰🇪

- Zimbabwe 🇿🇼

- South Africa 🇿🇦

- Hungary 🇭🇺

Below are territories where employees can receive foreign currency via the Playroll platform.

- Nigeria 🇳🇬

- Uganda 🇺🇬

- Zimbabwe 🇿🇼

- Hungary 🇭🇺

More countries to come and in beta, reach out to your Playroll representative if you have questions or would like to opt-in for non-local curency payments on your Playroll account.

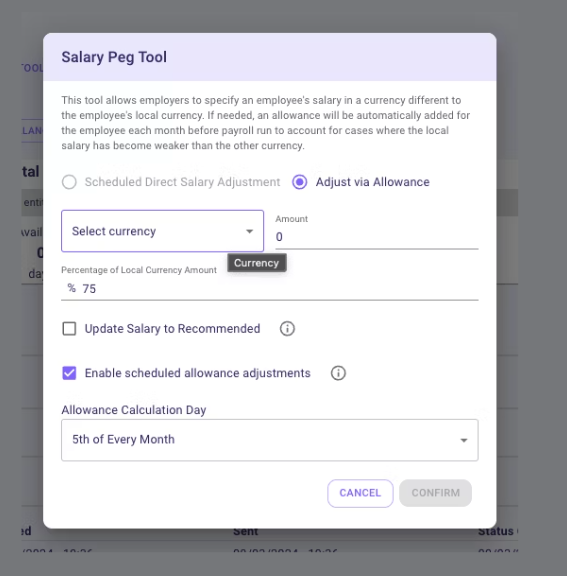

What is a pegged salary & when to offer it?

A currency peg is typically used to ensure the stability of the exchange rate between two countries, this especially benefits employees in territories with volatile local currencies.

Playroll allows two types of EOR employee contracts in a non-local currency

The first method would be tied to a foreign currency which is different to an employees local currency with a monthly variance. Here's the formula to calculate the variable pegged amount, current exchange rate – base exchange rate * basic salary. The monthly allowance is added to the employee's base salary to arrive at the total compensation for that month.

The second method would be tied to a foreign currency which is different to an employees local currency with no monthly variance. Employers commit to a fixed salary amount in a foreign currency, directly reflecting the global nature of business today. This approach guarantees that employees receive their salary based on the agreed foreign currency value, providing clarity and stability in compensation, irrespective of local currency fluctuations. Note, all bonuses, Commissions etc are all defined in the pegged currency from this point onwards.

Frequently Asked Questions

Can I offer this feature to existing EOR employees?

Depending on the country, it is possible to offer compensation in a non-local currency to existing EOR employees with active contracts but this cannot be done on the Playroll platform.

To offer this feature to existing employees, you can request a custom amendment on the Playroll platform that will be reviewed and drafted by our internal group. We will draft and send any applicable amendment documents for signature if needed.

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.svg)

.svg)