Copied to Clipboard

Ready to get Started?

Key Takeaways

Payroll mistakes are costly: Over half of companies have faced payroll penalties in the last five years, with IRS fines topping $7 billion annually. Hybrid and multi-state teams make compliance even trickier.

Laws vary and the strictest wins: From the FLSA to state-specific wage and overtime rules, employers must follow whichever law offers employees the greatest protection.

Proactivity beats penalties: Accurate classification, timely filings, secure data, and regular audits keep payroll compliant. Automation and expert support are key for multi-state or global teams.

Managing payroll compliance and tax regulations is one of the trickier aspects of running a business, especially when you're handling employees across multiple U.S. states or countries.

With the complexity of federal, state, and local laws constantly changing requirements, it’s no surprise that 53% of companies have faced payroll penalties for non-compliance in the last five years.

On top of that, 87% of companies report that the rise of hybrid and flexible working has put considerable pressure on payroll. As your team expands globally, getting your policies and payroll runs right, means the difference between avoiding these costly fines, penalties, and legal disputes, and effectively scaling your business. In this guide, we’ll simplify payroll compliance, highlight key regulations, share expert tips, and provide a handy checklist to ensure your payroll processes are seamless and legally sound.

What is Payroll Compliance?

Payroll compliance is how you follow the rules governing e employee wages, taxes, deductions, and benefits. From federal and state tax laws to maintaining accurate records and filing on time, it's about how you stay on top of your responsibilities as an employer.

Why is it Important?

Non-compliance can result in steep fines, audits, and lawsuits. The IRS estimates that payroll errors cost U.S. employers $7 billion annually in penalties. We’re willing to bet that your company wants to avoid contributing to that wild number for easily avoidable errors like failing to meet tax obligations or misclassifying your employees. Having a reliable payroll compliance system or partner is the best route when it comes to avoiding these risks.

Key Payroll Regulations and Laws in 2026

As regulations and laws continue to evolve, it's important to stay ahead of the curve. From federal tax rates to state-specific minimum wages and benefits, applying the key payroll laws will help you stay compliant and avoid potential legal and financial pitfalls.

Below, we'll break down the most critical payroll regulations for this year to help your business stay in the good books with the tax man.

Federal Regulations

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) sets the framework for minimum wage, overtime pay, and record-keeping requirements. Regulated by the Wage and Hour Division of the Department of Labor (DOL), the FLSA mandates the federal minimum wage rate of $7.25 per hour and overtime pay at 1.5 times the regular hourly rate for hours worked beyond 40 in a workweek.

Key Facts:

- Make sure you’re paying your employees at least the federal minimum wage rate of $7.25 per hour, but always check state regulations as some set higher minimums.

- Pay your employees overtime for any hours worked over 40 hours in a week at no less than 1.5 times their regular rate.

- 1 in 4 employees will look for a new job after the first payroll mistake your company makes, so it’s important to maintain accurate records of hours employees work and wages paid out.

- If you employ minors, you need to ensure you’re following FLSA guidelines that lay out what a safe working environment looks like. Your company is also required to make sure that younger employees have an opportunity to pursue an education.

IRS Payroll Taxes

The IRS Payroll Taxes include federal income tax, Social Security contributions, Medicare, and FUTA. Employers must withhold and remit these taxes to the IRS to maintain compliance.

Key Facts:

- When paying federal income tax, your company must withhold taxes based on the IRS withholding tables and report them on a Form 941 or Form 944 quarterly or annually.

- Social Security and Medicare taxes are part of FICA taxes (Federal Insurance Contributions Act), meaning your company must contribute a specific percentage for Social Security (6.2%) and Medicare (1.45%).

- As an employer, you are required according to the federal Unemployment Tax Act (FUTA), to pay tax on employee wages. This tax funds unemployment benefits but does not come out of your teams' paycheck.

Immigration Reform and Control Act (IRCA)

The Immigration Reform and Control Act (IRCA) requires employers to verify the eligibility of employees to work in the U.S. Employers must use Form I-9 to confirm an employee's identity and authorization to work.

Key Facts:

- Before adding someone to your payroll, you’ll need to verify their eligibility to work by completing the I-9 Form within three days of hiring, or face nasty penalties.

- Your organization needs to keep Form I-9 on record for three years after the official hire date or one year after employment ends, whichever is later.

- Failing to verify employment eligibility for any member of your team can lead to hefty fines and legal consequences for your company.

Affordable Care Act (ACA)

The Affordable Care Act (ACA) mandates that employers with 50 or more full-time employees provide health insurance coverage or face penalties such as a loss of tax credits. Employers must offer a health insurance plan that meets the minimum essential coverage standards set by the ACA.

Key Facts:

- If you have 50 or more full-time employees (or equivalent), your company must provide affordable health insurance to your employees.

- All U.S. employers must file Forms 1094-C and 1095-C with the IRS to prove that you’re offering the mandated health coverage to your team.

- These health plans need to fall within the affordability and minimum coverage standards outlined by the state (employees’ premium costs must not exceed 9.83% of household income).

State and Local Regulations

In addition to federal laws, businesses must comply with state and local regulations, which can vary widely. Some key areas of concern include:

- State Minimum Wage: Many states have set a higher minimum wage than the federal rate of $7.25 per hour. States like California and New York have significantly higher rates, and if you’re hiring in these states, you must adjust their payroll systems to meet these local wage requirements.

- State Overtime Rules: While the FLSA sets federal overtime standards, some states, such as California, have stricter overtime rules, including daily overtime after 8 hours of work.

- State Pay Transparency Laws: States like California and New York require employers to disclose salary ranges in job listings or provide pay transparency to ensure equity. These laws help to reduce wage disparities based on gender and other factors.

Payroll Compliance Checklist

Use this payroll checklist to ensure your business stays compliant and you don’t make any easily avoidable missteps:

- Verify employee classifications (full-time, part-time, independent contractor)

- Ensure federal, state, and local tax rates are correctly applied

- Confirm overtime and leave policies comply with local labor laws

- Keep accurate records of wages, deductions, and hours worked

- File payroll taxes on time (FUTA, FICA, federal income tax)

- Review health benefits and coverage under ACA

- Secure sensitive payroll data in compliance with data protection laws

- Stay informed about changes in payroll regulations

- Perform regular payroll audits for accuracy

While some aspects of payroll can be handled internally, the more complicated elements, like multi-state or international tax compliance, or navigating legal classifications, often require extra help. Partnering with a legal expert or third-party payroll provider to help you cross all the T’s and dot all the I’s, will cost less than the legal penalties from a payroll error.

10 Common Challenges in Running Complaint Payroll and Their Solutions

While there are challenges in managing payroll compliantly, having a proactive approach to problem-solving and the right tools in place will help you stay ahead of any potential pitfalls. These 10 expert tips will help you tackle common payroll challenges and ensure your payroll processes remain smooth and legally compliant, no matter where your business operates.

1. Stay Updated on Regulatory Changes

Tax rates, wage laws, and other regulations are always evolving. Staying on your toes and being aware of the latest changes should be top of your priority list. Changes can come at the federal, state, and local levels and may impact everything from minimum wage rates to overtime rules.

Expert Tip:

Subscribe to industry newsletters, follow government websites, and attend webinars or conferences on shifting regulations and labor laws. Setting aside time each month to check for regulatory updates is a simple way to stay ahead.

2. Accurately Classify Employees

Misclassification is a big compliance risk – whether it’s incorrectly labeling someone as an independent contractor or failing to designate an employee as exempt from overtime. Misclassifying employees can lead to fines, back taxes, and legal issues, so it's important to get it right from the start.

Expert Tip:

Regularly review job duties, employee status, and contracts to make sure everything aligns with IRS guidelines and state regulations. If you’re unsure, don’t hesitate to consult a labor attorney or payroll expert.

3. Ensure Timely Tax Filing

Late payroll tax filings can result in hefty fines, interest charges, and audits. Filing on time is one of the most critical compliance tasks, so it’s essential to set clear reminders and automate wherever possible to avoid human error.

Expert Tip:

Use payroll software to automate tax calculations and reminders for filing deadlines. Set up a payroll calendar to track quarterly, semi-annual, and annual filings, so you never miss a deadline.

4. Protect Employee Data with Robust Security Measures

Payroll involves highly sensitive information like Social Security numbers, bank account details, and salary info, which makes it a prime target for cybercriminals. Keeping your payroll data safe and secure is not just a good practice; it’s a legal requirement in many states and countries.

Expert Tip:

Invest in payroll software that uses encryption and complies with privacy regulations like the General Data Protection Regulation (GDPR) or California Consumer Privacy Act (CCPA). A general rule of thumb is to only partner with third-party providers that are SOC-2 compliant. Make sure your internal security protocols are regularly updated, and implement multi-factor authentication to safeguard access.

5. Maintain Accurate Recordkeeping

As an employer, you should keep records of wages, hours worked, and tax withholdings for several years, depending on federal and state regulations. This becomes even more critical in the event of an audit.

Expert Tip:

Use payroll software to automate recordkeeping and make it easy to generate reports when needed. Regularly back up your data and set a retention policy to ensure you’re keeping the necessary records for the required duration.

6. Master Overtime and Leave Management

Paying overtime correctly and managing leave policies according to federal and state regulations can be complex, especially when each state has its own rules. You need to make sure that you’re tracking overtime work and leave balances down to the minute to meet federal compliance standards.

Expert Tip:

Make sure your payroll system automatically calculates overtime pay based on both federal and state regulations. Similarly, track leave balances (vacation, sick, family leave, etc.) to comply with laws in your area.

7. Leverage Payroll Software for Automation

Manual payroll processing can introduce errors, delay payments, and lead to compliance issues. Automation is one of the easiest ways to stay compliant, reduce errors, and save time. Payroll software can manage everything from tax calculations to direct deposits, all while staying up to date with changing regulations.

Expert Tip:

Invest in payroll software that integrates with your HR systems without any disruptions to your workflow, and updates automatically based on changes in tax codes, wage laws, and reporting requirements.

8. Offer Ongoing Training for Payroll Staff

Payroll laws are constantly evolving, so it’s important that your payroll team stays up to speed with new regulations, best practices, and software updates. Regular training ensures your team is equipped to handle compliance challenges quickly and effectively as they pop up.

Expert Tip:

Organize quarterly training sessions for your payroll staff. Encourage them to attend webinars or workshops to keep their knowledge fresh, and consider subscribing to industry certifications or courses that provide in-depth legal training.

9. Conduct Regular Audits and Compliance Checks

Regular internal payroll audits are your best defense against discrepancies or compliance risks. Carrying out these audits will help you catch any errors before they escalate into more serious issues when your company is formally audited.

Expert Tip:

Schedule monthly or quarterly audits of payroll records, employee classifications, tax filings, and deductions. This proactive approach helps you stay ahead of potential issues and allows for quick fixes when needed.

10. Collaborate with Payroll Compliance Experts

When managing payroll across multiple jurisdictions, especially internationally, you want to have the right experts on your team. Navigating local labor laws, tax regulations, and payroll requirements can be overwhelming, but expert guidance can help you stay compliant and mitigate risks.

Expert Tip:

If your business operates across borders or multiple states, consider partnering with a payroll service provider or consulting with compliance experts who can ensure your payroll processes adhere to both local and international regulations.

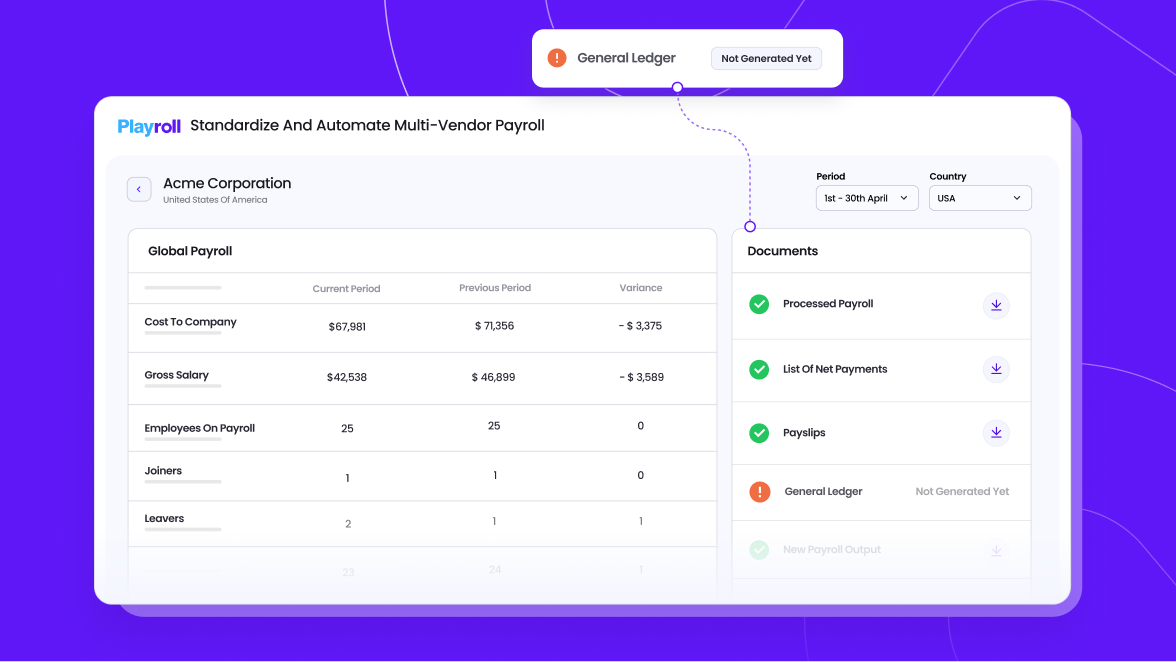

Manage Payroll and Compliance with Playroll

At the end of the day, payroll compliance is non-negotiable to make sure your team is paid correctly and on time, while protecting your business. With the right tools and knowledge, you can do just that, but if you’re looking for an expert helping hand – why not try us out?

Playroll offers tools that simplify payroll processing, keep you updated on regulatory changes, and ensure you stay compliant wherever your team is based. Book a demo with our expert team today.

Payroll Compliance FAQs

How do you ensure payroll compliance?

.png)

Ensuring payroll compliance starts with staying on top of all the laws: federal, state, and local. That means keeping an eye on everything from tax rates to minimum wage laws and regulations around overtime. Conducting regular audits, accurate employee classifications, and timely tax filings are key to keeping everything in check and avoiding costly mistakes.

Who is responsible for payroll compliance?

.png)

Ultimately, you (the business owner) are responsible for payroll compliance. While your HR or payroll team handles the day-to-day, it’s up to you to ensure everything aligns with the law. But you can always partner with payroll experts like an EOR, or legal advisors to help navigate the more complicated areas, especially if your business operates across multiple states or countries. This will shift the compliance responsibility over to that partner.

What are the key federal payroll compliance regulations?

.png)

The key federal payroll compliance regulations that you and your company need to be aware of are the Fair Labor Standards Act (FLSA) which sets the minimum wage and overtime rules. Then, there are the IRS payroll taxes, like federal income tax, Social Security, and Medicare contributions. Finally, the Immigration Reform and Control Act (IRCA) requires you to verify your employees’ eligibility to work.

How do state payroll laws differ from federal laws?

.png)

Many states set their own minimum wage, which can be higher than the federal rate. And if you’re in a state like California or New York, you’ll need to be extra mindful of stricter overtime laws, paid sick leave, and other special requirements. On top of that, some cities have additional payroll rules or taxes, which can make it even trickier.

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.svg)

.svg)