Copied to Clipboard

Ready to get Started?

.png)

Key Takeaways

Freelancing has boomed since the rise of remote work post-pandemic. For example, 60 million Americans now work as contractors, contributing $1.35 trillion to the U.S. economy. But managing contractor payroll can quickly get tricky, especially if you operate across borders. Between 1099s, global payments, and shifting regulations, it’s easy to make costly mistakes. Misclassifying a contractor, for example, could cost them nearly $20,000 a year in lost income and benefits and puts your business at risk of steep penalties.

That’s where contractor payroll services come in handy – these specialized solutions do more than only pay contractors. They’re built to handle global payments, varying tax laws, and contractor compliance in one. The right contractor payroll platform can help you avoid penalties and maintain strong relationships with independent contractors.

Below, we’ll dive into our pick of the best contractor payroll services. Here’s a summary of their key features, as well as pricing.

TL;DR Comparison of Best Contractor Payroll Software

How We Selected the Best Contractor Payroll Software

Compliance & Tax Support

We’ve chosen software that ticks the boxes on compliance for payroll for contractors. Leading platforms handle local and global tax rules, automating filings, generating 1099s, and tracking deductions like Social Security. This ensures you stay audit-proof and helps mitigate legal risks and financial penalties.

Ease of Use

A payroll service for small businesses should be easy to use, with straightforward ways to access payroll data and make updates that cut down on admin work. Independent contractors should be able to view pay stubs, submit info like bank account details, and get paid, all without emailing HR.

Automation & Integrations

Automating payroll for contractors reduces human error and saves time. The top solutions integrate with accounting software like QuickBooks and Xero and offer independent contractor payroll software to streamline payments.

Global Payment Capabilities

If you hire internationally, you’ll need multi-currency support, compliant contracts, and local tax handling. The best payroll services offer transparent fees and flexible payment methods.

Customer Reviews

We relied on reviews from G2, Capterra, and Trustpilot to find tools that deliver consistent results in real-world settings.

7 Best Payroll Software for Contractors for 2026

These platforms offer a variety of features designed to simplify payroll management, streamline tax compliance, and enhance the overall efficiency of your business operations.

1. Playroll: Best for Global Payments & In-Country Compliance

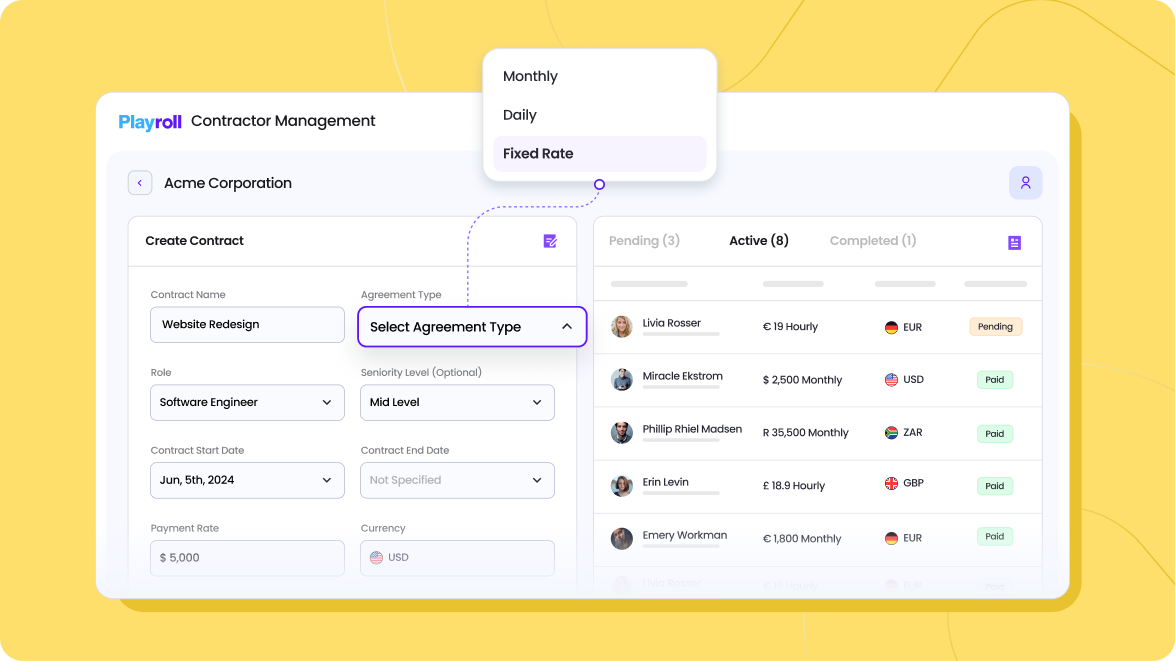

Playroll makes it simple to pay your team across the world – whether you’re paying employees or working with international contractors. Everything lives in one platform, so you can stay compliant, automate approvals, and see exactly what’s happening across every market in real time.

For contractors, Playroll works like a connected ecosystem that handles onboarding, contracts, and payments – with coverage in 180+ countries and support for 60+ currencies. It automatically applies local compliance rules, takes care of tax documentation, and protects your IP from day one. Playroll’s global payroll services offers a unified way to run payroll globally and bring your fragmented payroll data together – streamlining reviews, reporting, and reconciliation in one place.

Key Features

- Unify payroll processing across countries and manage all employee and contractor data in one platform.

- Automatically apply local labor laws and tax requirements before payroll runs to ensure full in-country compliance.

- Catch errors early with AI-powered variance detection and automated validation checks.

- Customize payroll approval workflows to match how your finance and HR teams operate.

- Access real-time reporting and consolidated analytics across every market you hire in.

- Automate calculations, filings, and currency conversions to reduce manual work and processing time.

Pricing Plans

Contractor Management Services: $35 p/contractor. Flat fee per month.

What Users Love About Playroll

“The most helpful part of using Playroll is how it simplifies managing payroll and HR tasks from one platform. I have a clear view of all my payrolls, documents, and submitted data, which makes it easy to stay organized.”

- Verified G2 User

2. ADP: Best for Large Enterprises

ADP is a comprehensive payroll service solution designed for large enterprises managing a high volume of employees and contractors. It is beneficial for organizations looking for a scalable payroll system, capable of handling complex payroll needs across different countries.

However, its robust feature set can come with a higher cost and a steeper learning curve, which may not be ideal for smaller teams or those seeking a simpler solution.

Key Features

- Handles tax deductions and facilitates direct deposit for contractors.

- Supports international payments and ensures compliance with global payroll regulations.

- Manages benefits such as health insurance, retirement plans, and other contractor-specific perks.

Pricing Plans

Custom pricing based on company size and requirements.

3. Gusto: Best for Small to Medium Businesses

Gusto is a user-friendly payroll solution ideal for small to mid-sized businesses, especially those paying 1099 contractors. It automates tax filing, supports direct deposit, and integrates with tools like QuickBooks and Xero.

However, it may lack the advanced features needed by rapidly scaling or international companies.

Key Features

- Simplifies paying contractors directly, with tax forms like 1099 automatically generated.

- Automates payroll calculations and filings, reducing errors and time spent on administrative tasks.

- Integrates with accounting tools like QuickBooks and Xero.

Pricing Plans

$35 p/month for contractors, plus $6 p/person.

4. SurePayroll: Best for Small Businesses

SurePayroll is an affordable, no-frills payroll solution ideal for small businesses or startups with tight budgets. It offers automated payroll, tax filing, and compliance at a low cost. However, it may lack advanced features needed by growing or more complex businesses.

Key Features

- Provides budget-friendly payroll services for small businesses.

- Handles federal, state, and local tax filings.

- Supports direct deposit and automated 1099 payments.

Pricing Plans

Starts at $19.99/month.

5. Justworks: Best for Compliance Management

Justworks is a compliance-focused payroll platform ideal for businesses with contractors or remote teams. It manages tax filings, benefits, and worker classification to help companies stay legally compliant. However, its higher cost may be a barrier for smaller businesses with limited budgets.

Key Features

- Manages local state and federal tax filings and ensures legal compliance for contractors.

- Handles payroll and offers health benefits, workers’ compensation, and 401(k) plans for contractors.

- Provides expert guidance to ensure proper contractor classification to avoid legal issues.

Pricing Plans

Custom pricing based on company size and contractor needs.

6. Paychex: Best for Scalable Payroll

Paychex is a scalable payroll solution for businesses of all sizes, offering automated tax filing, benefits management, and direct deposit. It supports both employees and contractors and provides personalized service to match business needs. However, its interface can feel outdated compared to newer, more modern platforms.

Key Features

- Adapts to the changing needs of businesses, from small startups to large enterprises.

- Ensures timely and accurate filing of payroll tax.

- Offers a range of benefits solutions for employees and contractors.

Pricing Plans

Custom pricing based on business size and needs.

7. QuickBooks Payroll: Best for Accounting Integration

QuickBooks Payroll is an add-on for businesses already using QuickBooks, automating payroll, taxes, and benefits while integrating with financial reporting tools. It's ideal for those seeking a unified system. However, it may offer limited value to businesses not already in the QuickBooks ecosystem.

Key Features

- Integrates effortlessly with QuickBooks accounting software.

- Automates payroll and tax calculations for accuracy and compliance.

- Pays employees and contractors quickly and easily.

Pricing Plans

Starts at $22.50/month + $4 per employee.

Key Features to Look for in Contractor Payroll Software

- Automated Payments & Tax Compliance: Ensures accurate payroll is processed with built-in tax reporting, so you can save time doing more strategic work.

- Multi-Currency Support: For businesses paying international contractors, your payroll solution should support payments in every region where you operate.

- Integration with Accounting Tools: Sync payroll data with QuickBooks, Xero, or NetSuite.

- Time Tracking & Invoicing: Helps manage contractor work hours and invoices.

- Compliance Management: Supports tax laws such as 1099 (US) and IR35 (UK).

Simplify Your Contractor Payroll Operations with Playroll

The right payroll system does more than just send payments. It protects you from legal risks, keeps your finances clean, helps you stay up to date with compliance laws, and strengthens your global workforce. Playroll ticks all these boxes, helping you manage international contractors with built-in compliance, analytics, and tax support in one place.

Book a chat with our team to simplify how you work with contractors across borders.

Contractor Payroll FAQs

What is the best payroll service for independent contractors?

.png)

The best payroll service for independent contractors depends on your business needs. Here are some top options:

- Playroll: Specifically designed for contractors, offering flexible payroll solutions and compliance management, stating at $35 p/contractor. Flat fee per month.

- Gusto: Great for small to medium-sized businesses, starting at $35/month + $6 per contractor.

- Square Payroll: Ideal for Square users, starting at $5/month.

- OnPay: Affordable and easy to use, starting at $36/month.

- Patriot Software: Budget-friendly, starting at $17/month + $4 per contractor.

- Justworks: Offers compliance management, starting at $59/month per employee.

How do I set up payroll for a contractor?

.png)

To set up payroll for a contractor, first gather their details (name, SSN/TIN, payment preferences) and ensure they are classified as an independent contractor. Choose a payroll service (like Playroll or Gusto) to manage payments and 1099 filings. Set payment terms (e.g., weekly or monthly) and ensure tax compliance by sending the correct 1099 forms at year-end. Using the right payroll platform will help ensure timely, compliant payments for contractors.

What's the best way to do payroll for a small business?

.png)

The best way to handle payroll for a small business is by using an automated payroll service like Playroll, Gusto, or QuickBooks Payroll. These platforms simplify the process by handling tax calculations, deductions, and filing requirements, saving you time and reducing the risk of errors. Choose a service that fits your business needs and budget, offers direct deposit, and helps with compliance, such as providing year-end tax forms. Alternatively, you can manage payroll manually with software, but using a payroll service is often the most efficient and reliable option.

.svg)

.svg)

.svg)

.svg)

.svg)

.png)

.svg)

.png)

.svg)