The United States is a high-cost but high-talent hiring market, especially in major hubs such as San Francisco, New York, Seattle, and Boston. Beyond gross salary, your company must budget for employer-side FICA taxes, federal and state unemployment insurance, and often health, retirement, and other benefits.

Below are average monthly costs for popular roles in 2026, combining typical market salaries with standard employer payroll tax assumptions of roughly 8%-10% of wages, before any optional benefits such as health insurance or 401(k) matches. Figures are estimates for full-time roles in major U.S. cities and will vary by state, seniority, industry, and whether you offer richer benefits or equity.

- Software Engineer:

Average salary USD 10,800 + employer contributions USD 1,000 = Estimated Total Monthly Cost USD 11,800. Compensation can be meaningfully higher in top tech hubs or for senior, AI, data, or infrastructure specialists, and lower in non-coastal regions or for more junior roles. - Product Manager:

Average salary USD 11,700 + employer contributions USD 1,100 = Estimated Total Monthly Cost USD 12,800. Product leaders in SaaS, fintech, and consumer tech often command premium cash compensation plus equity, while mid-market or traditional-industry roles may sit closer to or below these levels. - Marketing Specialist:

Average salary USD 5,800 + employer contributions USD 520 = Estimated Total Monthly Cost USD 6,320. Digital marketers with strong performance, SEO, or paid media skills typically earn toward the higher end of the range, especially in agencies and high-growth startups. - Customer Support Representative:

Average salary USD 4,000 + employer contributions USD 360 = Estimated Total Monthly Cost USD 4,360. Wages vary based on location, shift work, union status, and whether the role is phone-based, technical support, or largely email and chat focused. - HR Manager:

Average salary USD 9,200 + employer contributions USD 830 = Estimated Total Monthly Cost USD 10,030. HR professionals experienced with multi-state compliance, benefits strategy, and scaling distributed teams generally attract higher compensation, particularly in larger or fast-growing organizations.

Figures may differ based on the state unemployment insurance rate you are assigned, your benefit design, and whether you operate in premium labor markets or lower-cost regions.

💡 Curious how much it would cost to hire your next role in United States? Use our Salary Benchmarking Tool to get an instant, role-specific estimate - including taxes and compliance costs.

When you hire in the United States, salary is only the starting point. You also need to factor in mandatory payroll taxes, health coverage expectations, leave policies, and state-level rules that can materially change your total employer cost.

In 2026, statutory employer payroll taxes such as Social Security, Medicare, and unemployment insurance typically add around 8%-10% of wages, while competitive benefits packages can add a further 15%-25% depending on your plan design and cost-sharing policies.

Leave and Paid Time Off

The United States has no federal requirement for paid vacation or public holidays, so annual leave is driven by company policy, often 10-20 days plus paid holidays. Federal law provides job-protected but unpaid leave under the FMLA, and some states mandate paid sick or family leave that you must fund.

Mandatory Employer Contributions

Your company must pay employer-side FICA contributions at 6.2% for Social Security up to the annual wage base and 1.45% for Medicare with no cap, plus federal and state unemployment insurance. State unemployment rates vary by state and your experience rating, so budgeting a blended 1%-3% of wages is common.

Probation and Notice Periods

The United States largely follows at-will employment, meaning there is typically no statutory probation or minimum notice period for either party. Some employers use contractual probation periods and notice expectations, which can create de facto severance or garden-leave costs for senior hires.

Compensation Structure and Bonuses

U.S. compensation usually combines base salary with variable components such as annual bonuses, commission plans, and equity for eligible roles. A 13th-month salary is not mandatory or typical in the United States, but sales incentives and performance-based bonuses are common and should be budgeted as part of on-target earnings.

Social Security and Tax Compliance

As an employer in the United States, you must withhold federal income tax, Social Security, and Medicare from employee pay and remit both employee and employer portions on a regular deposit schedule. You also need to handle quarterly payroll tax filings, year-end W-2 reporting, and any state or local income tax obligations.

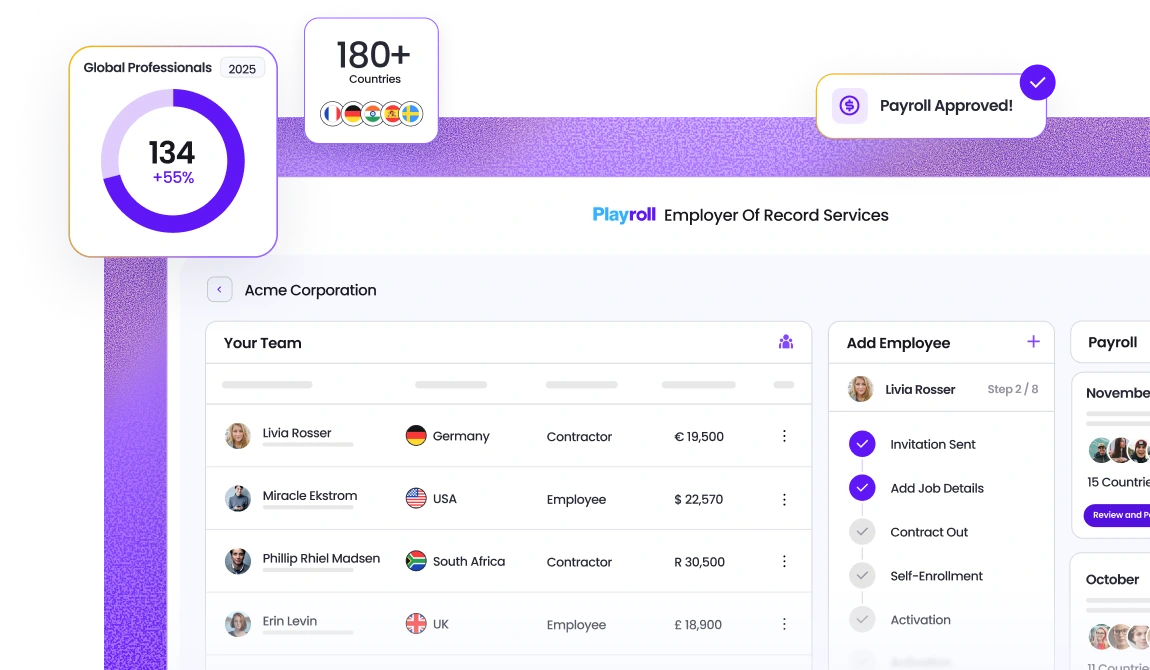

Hiring and Engagement Models

You can hire directly through your own U.S. entity or work with an Employer of Record that becomes the legal employer on paper while you manage day-to-day work. Independent contractors are also used, but strict U.S. and state misclassification rules mean you should treat contractor engagement as a deliberate, low-risk choice.

Bring them on board seamlessly with Playroll. Our legal experts handle compliance so you don’t have to.

Book a DemoHere are six actionable ways to make your hiring strategy more cost-efficient – wherever you’re building your team.

- Plan Around Statutory Contribution Caps

Most countries set salary ceilings for mandatory employer contributions like pensions, healthcare, or unemployment insurance. Once an employee’s earnings exceed that cap, your contribution amount stays fixed. Mapping compensation bands against these limits before finalizing offers helps you remain competitive without paying unnecessary premiums. - Localize Benefits Strategically

Every market values different perks. Instead of applying a global benefits template, align packages to local expectations and cultural norms. In some regions, private healthcare or transport allowances are far more attractive than bonuses or extra paid leave. Prioritize what your team will value most and trim the rest – you’ll keep engagement high while reducing spend. - Consider an Employer of Record (EOR)

Running your own entity can be expensive – local payroll systems, tax filings, and compliance administration add up fast. Partnering with a trusted EOR like Playroll simplifies hiring anywhere in the world. We manage contracts, benefits, payroll, and compliance for you, all under one transparent monthly fee. It’s the easiest way to scale globally without unexpected costs or compliance risks. - Revisit Employment Contract Types and Terms

Not every role needs to be permanent or full-time. Many labor frameworks allow fixed-term or project-based contracts, which can offer both flexibility and cost control. Be intentional about probation periods, notice clauses, and renewal terms – clear definitions reduce risk and prevent costly disputes later. - Explore Cross-Border Hiring Options

If a role doesn’t require strict on-site presence, widen your search to include neighboring or lower-cost markets. With compliant hiring solutions, you can engage top talent in other countries while reducing salary and overhead costs – all without setting up additional legal entities. - Build Internal Mobility

Before recruiting new talent, look at who you already have. Upskilling or promoting existing employees can fill gaps faster and for less cost than external recruitment. This also boosts retention and engagement, since employees see clear career progression within your organization.

What is the average employer cost of hiring in United States in 2026?

.png)

In 2026, typical employer costs in the United States for mid-level professionals range from roughly USD 6,000 to USD 13,000 per month, including payroll taxes and standard benefits. Final costs vary by city, industry, and how generous your compensation package is.

Are there regional or industry-specific variations in employer costs in United States?

.png)

Employer costs in the United States differ markedly between high-cost hubs and lower-cost regions, and between premium-paying sectors and others. Tech, finance, and biotech roles usually command higher salaries and bonuses than many public sector or non-profit positions.

What is the estimated timeline for hiring in United States?

.png)

In the United States, most professional roles take about 4-8 weeks to fill, while senior or niche hires can take longer. Timelines depend on market competition, role complexity, and your internal interview process.

What factors impact the cost of hiring in United States?

.png)

Hiring costs in the United States are shaped by geography, role level, industry, and benefits. Payroll taxes, health coverage, retirement plans, and bonuses can add substantially to base salary when you budget for new hires.

How often do employment-cost rules change in United States?

.png)

In the United States, payroll tax thresholds, unemployment rates, and state-level wage or leave rules are updated frequently, often every year. Employers should monitor federal and state changes regularly to keep hiring budgets and payroll compliant.

.svg)

.svg)

.svg)

.svg)

.svg)