Bangladesh offers a large, growing talent pool, particularly in Dhaka and Chattogram, at competitive cost compared with many other Asian markets. Your total employer cost includes gross salary plus mandatory contributions to provident fund or gratuity (if applicable) and statutory bonuses, as well as payroll taxes and benefits you choose to add.

Below are average monthly costs for popular roles in 2026, combining typical market salaries with common employer-side costs such as provident fund or end-of-service benefits, bonuses, and other payroll overheads. Figures are estimates for full-time roles in major cities and will vary by seniority, industry, and your specific benefits. USD values assume BDT 110 ≈ USD 1 and are rounded.

- Software Engineer:

Average salary BDT 120,000 (≈ USD 1,090) + employer contributions BDT 24,000 (≈ USD 220) = Estimated Total Monthly Cost BDT 144,000 (≈ USD 1,310). Costs run lower for junior developers and higher for engineers with cloud, data, or international product experience, especially in export-focused tech companies. - Product Manager:

Average salary BDT 180,000 (≈ USD 1,640) + employer contributions BDT 36,000 (≈ USD 330) = Estimated Total Monthly Cost BDT 216,000 (≈ USD 1,970). Product leaders with strong SaaS, fintech, or global-market exposure can command higher packages and may negotiate performance bonuses or equity-style incentives. - Marketing Specialist:

Average salary BDT 80,000 (≈ USD 730) + employer contributions BDT 16,000 (≈ USD 145) = Estimated Total Monthly Cost BDT 96,000 (≈ USD 875). Digital, performance, and growth marketers with strong analytics or paid-media skills usually sit at the upper end of the range, particularly in tech and e-commerce. - Customer Support Representative:

Average salary BDT 45,000 (≈ USD 410) + employer contributions BDT 9,000 (≈ USD 80) = Estimated Total Monthly Cost BDT 54,000 (≈ USD 490). English-speaking agents handling international customers, night shifts, or complex products can cost more and may also receive shift, attendance, or transport allowances. - HR Manager:

Average salary BDT 150,000 (≈ USD 1,360) + employer contributions BDT 30,000 (≈ USD 275) = Estimated Total Monthly Cost BDT 180,000 (≈ USD 1,635). HR leaders experienced in Bangladesh labor law, provident fund or gratuity schemes, and multinational standards often attract a premium, particularly in larger or foreign-invested organizations.

Figures may differ depending on current exchange rates and your internal policies on bonuses, health coverage, allowances, and long-term incentives.

💡 Curious how much it would cost to hire your next role in Bangladesh? Use our Salary Benchmarking Tool to get an instant, role-specific estimate - including taxes and compliance costs.

When you hire in Bangladesh, salary is only one line item. You also need to factor in statutory leave, festival bonuses, possible provident fund or gratuity schemes, income-tax withholding, and the way local contracts handle probation, notice, and termination.

Depending on your structure and benefits, these additional costs can add roughly 10%-25% on top of base salary, before any optional medical insurance, transport support, or performance-linked incentives.

Leave and Paid Time Off

Bangladesh labour law provides annual leave that typically accrues to at least 10-18 working days per year depending on the sector and working schedule. You also need to plan for paid festival and casual leave, sick leave, maternity leave, and widely observed public holidays when staffing and budgeting teams.

Mandatory Employer Contributions

Bangladesh does not impose a single universal social security contribution similar to some countries, but employers often fund contractual benefits like provident fund or gratuity. These schemes commonly add around 8%-16% of basic salary to your monthly cost base, depending on your policy design and eligibility rules.

Probation and Notice Periods

Probation periods in Bangladesh often range from three to six months, during which termination can be somewhat more flexible if contracts clearly define conditions. After confirmation, statutory and contractual notice periods apply, and you may owe pay in lieu or severance, which raises the effective cost of terminations.

Compensation Structure and Bonuses

Compensation in Bangladesh is frequently structured around basic salary plus allowances for housing, medical, transport, or lunch, which can influence payroll cost and tax treatment. A 13th-month or festival bonus is not strictly universal but is widely practiced, especially in larger companies, and should be budgeted as part of annual compensation.

Social Security and Tax Compliance

There is no broad national social insurance system for private employers, but you must register for tax, withhold income tax at source, and remit it to the National Board of Revenue on prescribed schedules. Accurate withholding, timely filing, and proper documentation are essential to avoid penalties and manage long-term operating risk in Bangladesh.

Hiring and Engagement Models

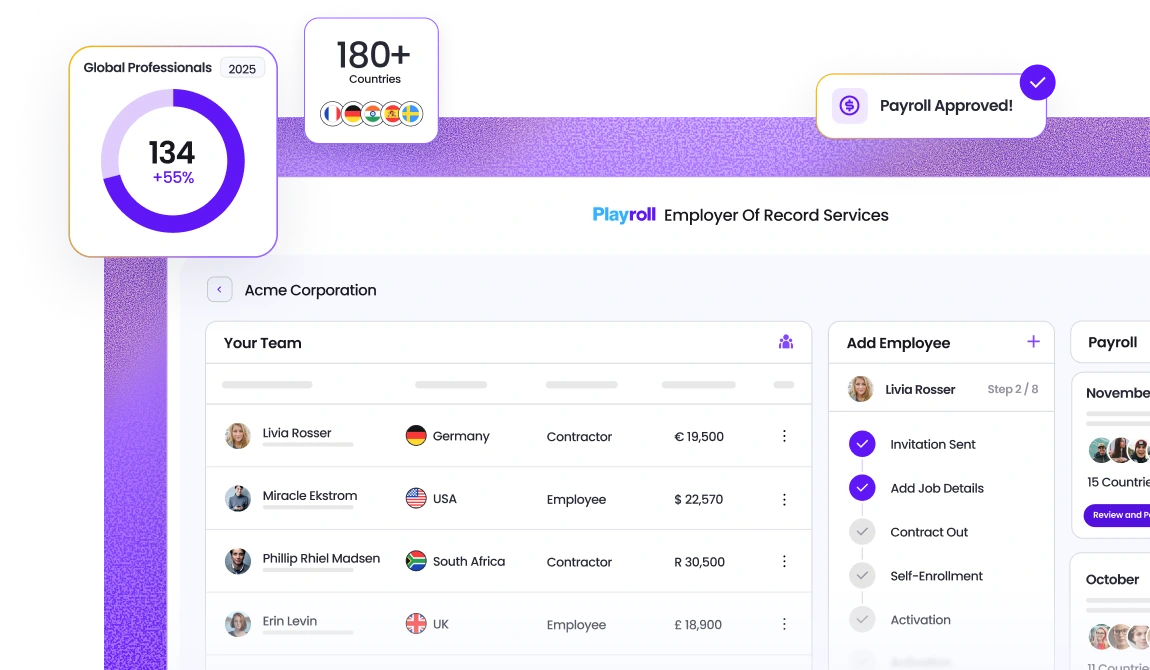

If you do not have a local entity in Bangladesh, working with an Employer of Record lets you compliantly hire local talent without setting up a company. If you operate your own entity, you will manage contracts, payroll, and compliance directly, so you must fully understand all mandatory payments and typical market benefits when modelling total cost of employment.

Bring them on board seamlessly with Playroll. Our legal experts handle compliance so you don’t have to.

Book a DemoHere are six actionable ways to make your hiring strategy more cost-efficient – wherever you’re building your team.

- Plan Around Statutory Contribution Caps

Most countries set salary ceilings for mandatory employer contributions like pensions, healthcare, or unemployment insurance. Once an employee’s earnings exceed that cap, your contribution amount stays fixed. Mapping compensation bands against these limits before finalizing offers helps you remain competitive without paying unnecessary premiums. - Localize Benefits Strategically

Every market values different perks. Instead of applying a global benefits template, align packages to local expectations and cultural norms. In some regions, private healthcare or transport allowances are far more attractive than bonuses or extra paid leave. Prioritize what your team will value most and trim the rest – you’ll keep engagement high while reducing spend. - Consider an Employer of Record (EOR)

Running your own entity can be expensive – local payroll systems, tax filings, and compliance administration add up fast. Partnering with a trusted EOR like Playroll simplifies hiring anywhere in the world. We manage contracts, benefits, payroll, and compliance for you, all under one transparent monthly fee. It’s the easiest way to scale globally without unexpected costs or compliance risks. - Revisit Employment Contract Types and Terms

Not every role needs to be permanent or full-time. Many labor frameworks allow fixed-term or project-based contracts, which can offer both flexibility and cost control. Be intentional about probation periods, notice clauses, and renewal terms – clear definitions reduce risk and prevent costly disputes later. - Explore Cross-Border Hiring Options

If a role doesn’t require strict on-site presence, widen your search to include neighboring or lower-cost markets. With compliant hiring solutions, you can engage top talent in other countries while reducing salary and overhead costs – all without setting up additional legal entities. - Build Internal Mobility

Before recruiting new talent, look at who you already have. Upskilling or promoting existing employees can fill gaps faster and for less cost than external recruitment. This also boosts retention and engagement, since employees see clear career progression within your organization.

What is the average employer cost of hiring in Bangladesh in 2026?

.png)

In 2026, typical total employer cost in Bangladesh for mid-level roles ranges around BDT 70,000-220,000 per month plus 10%-25% for benefits and bonuses. Actual costs vary by role, industry, and benefit structure.

Are there regional or industry-specific variations in employer costs in Bangladesh?

.png)

Employer costs in Bangladesh vary by city and industry, with Dhaka and Chattogram and sectors like tech and finance paying higher salaries and richer benefits. Smaller local firms and secondary cities tend to have more moderate cost levels.

What is the estimated timeline for hiring in Bangladesh?

.png)

Most employers should expect a four to eight week hiring timeline in Bangladesh, with longer cycles for senior or highly specialised roles. Efficient processes and a clear employer brand help reduce time to hire.

What factors impact the cost of hiring in Bangladesh?

.png)

Total hiring cost in Bangladesh is driven by role level, sector, city, compensation structure, bonuses, and statutory or contractual benefits. Foreign employers often pay more for strong English skills and specialised experience.

How often do employment-cost rules change in Bangladesh?

.png)

In Bangladesh, core labour rules are fairly stable but tax and payroll-related provisions can change with new budgets or regulatory updates. Regular monitoring or partnering with local experts is important to keep employment costs compliant.

.svg)

.svg)

.svg)

.svg)

.svg)