Who Is Entitled to Employee Benefits In Finland?

In Finland, nearly all employees are entitled to a robust range of employee benefits, backed by strong labor laws and a universal social security framework. Finnish legislation and collective bargaining agreements (CBAs) define minimum standards that employers must meet, ensuring consistency across industries and sectors.

Both full-time and part-time employees are generally covered under these rules, including those on fixed-term contracts. While the scope of benefits may vary depending on working hours or the applicable CBA, most employees still qualify for key entitlements like paid leave and occupational healthcare if they meet basic employment thresholds.

Overview of Employee Benefits In Finland

Employee benefits in Finland are some of the most comprehensive in Europe, reflecting the country’s commitment to equality, social welfare, and employee well-being. In the Finnish workplace, benefits aren’t just a nice bonus – they’re a central part of employment and retention strategy.

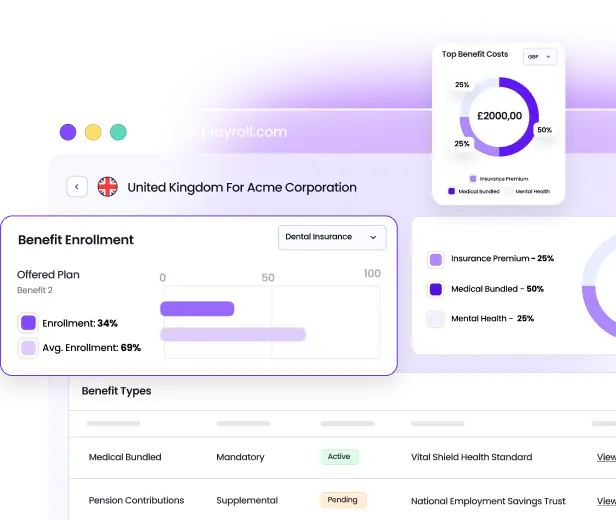

Mandatory benefits provide a dependable foundation, while supplemental perks help employers stay competitive in a workforce that values flexibility and security. Below is a breakdown of the typical benefits you’ll see in Finland:

Mandatory Employee Benefits In Finland

Mandatory benefits are legally required and form the core of any employee benefits package in Finland. Here’s a comprehensive list of mandatory benefits in Finland:

Occupational Healthcare

All employers must provide occupational healthcare to their employees, including part-time staff. This benefit is aimed at preventing work-related illnesses, supporting early intervention, and offering essential medical services. Employers must partner with either private providers or public municipal health services and maintain a written occupational healthcare agreement.

Paid Annual Leave

Under the Annual Holidays Act, employees accrue 2–2.5 days of paid leave per working month, depending on tenure. This ensures generous time off to promote rest and work-life balance. Employers are required to document leave accruals and provide compensation for unused leave under certain conditions.

Sick Leave & Sickness Allowance

Employees are entitled to paid sick leave, typically funded by the employer for the first few days (determined by the CBA), after which sickness allowance is paid by Finland’s social insurance provider, Kela. Proper medical documentation must be provided, and employers must comply with payment calculation standards.

Parental Leave & Family Benefits

Finland’s family-friendly policies offer various types of leave – pregnancy leave, parental leave, and shared family leave – mostly funded by Kela. Depending on the CBA, employers may also provide wage top-ups during leave periods. These benefits promote gender equality and support for working families.

Public Pension Contributions

Employers must contribute to the earnings-based pension system (TyEL). Contribution amounts depend on employee age and wages and are adjusted annually. Employers are also responsible for deducting employee contributions and reporting earnings to the national pension registry.

Supplemental Employee Benefits In Finland

Supplemental benefits are not required by law, but can help you stand out as an employer and attract top talent. They include:

Meal Vouchers / Commuter Benefits

These benefits are commonly offered and provide tax-advantaged support for meals and commuting. They are regulated by Finnish tax authorities, with clear guidelines on limits and usage. These benefits offer practical day-to-day value for employees and contribute to a positive work culture.

Supplemental Health Insurance

While basic healthcare is required, employers often offer private insurance to give employees faster access to services like specialist care or mental health support. Policies are typically managed through insurance providers, and compliance focuses on tax reporting and documentation.

Wellness Allowances (Sports & Culture Vouchers)

Employers can provide sports and culture vouchers as a wellness initiative. These are tax-deductible within limits and encourage employees to maintain a healthy, active lifestyle. Options can include gym memberships, concert tickets, or art classes.

Additional Pension Contributions

Voluntary pension top-ups are often offered to senior-level or long-tenured employees. These are managed through insurance companies and governed by tax limits. They’re a key part of competitive benefits packages focused on long-term security.

Remote Work Stipends & Home Office Equipment

With remote work now normalized, many Finnish employers offer stipends for broadband, desks, or ergonomic chairs. Though not legally required, these benefits support productivity and comfort and are subject to standard documentation and tax rules.

Tax Implications of Employee Benefits in Finland

Most benefits in Finland come with specific tax treatments. Key points include:

- Tax-exempt: Occupational healthcare and certain wellness allowances

- Tax-advantaged: Meal vouchers, commuter benefits, and culture/sports vouchers (within set thresholds)

- Documentation required: Payroll records, benefit summaries, receipts, and provider invoices for reporting to the national income register

Employers must carefully manage taxable and non-taxable items to avoid compliance issues and take full advantage of any available tax benefits.

Legal Considerations for Employee Benefits in Finland

Employee benefits in Finland are tightly regulated. Employers must comply with several core laws, including the Employment Contracts Act, Occupational Health Care Act, Working Hours Act, and Annual Holidays Act. Additionally, most industries have collective bargaining agreements that may require more generous benefits than the legal minimums.

Failure to comply can result in fines, back payments, or legal disputes. Transparency and documentation are essential. Finnish employees expect a high level of reliability from their employers, so reviewing benefits annually – or when laws or CBAs change – is a smart best practice.

Employers must also be mindful of changing tax laws and social security reporting obligations to avoid compliance risks.

How Benefits Impact Employee Cost

Mandatory benefits – like pensions, paid leave, and occupational healthcare – add significant cost to total compensation in Finland. However, these costs contribute to a more stable, healthy, and loyal workforce.

Employers can manage costs by choosing tax-efficient supplemental benefits, tailoring offerings to employee needs, and prioritizing perks that improve retention and engagement. Strong benefits reduce turnover, improve satisfaction, and support long-term performance.

Disclaimer

THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE LEGAL OR TAX ADVICE. You should always consult with and rely on your own legal and/or tax advisor(s). Playroll does not provide legal or tax advice. The information is general and not tailored to a specific company or workforce and does not reflect Playroll’s product delivery in any given jurisdiction. Playroll makes no representations or warranties concerning the accuracy, completeness, or timeliness of this information and shall have no liability arising out of or in connection with it, including any loss caused by use of, or reliance on, the information.

.svg)

.svg)

.svg)

.svg)

.png)

.webp)

.svg)